Raising funds for emerging managers has historically been difficult, especially in the challenging landscape of the past year, which has been marked by slow exits, a high-interest rate environment, and macroeconomic pressures. However, impact funds have bucked this trend, offering significant opportunities for newcomers.

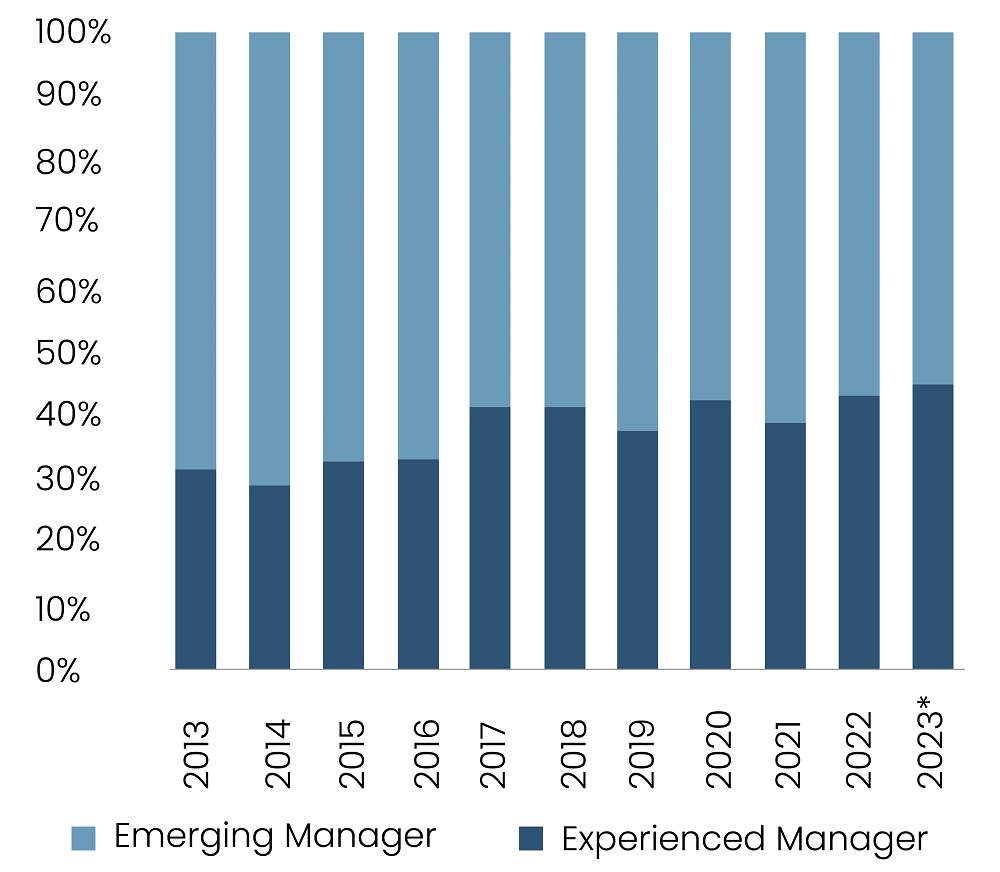

In recent years, there has been a notable preference among investors for larger and more experienced managers, leaving fund managers with shorter track records facing challenges in raising capital. This trend has been intensified since the slowdown in PE fundraising, with newer managers receiving a notably smaller share of the fundraising pool than usual. According to Buyout, first-time funds globally raised around $25 billion in 2023, marking a substantial decline from the $47.6 billion raised in 2022. Additionally, Pitchbook reports that experienced managers accounted for a dominant 62.3% of the total fund count in 2023, highlighting investors’ cautious approach and preference for established managers under difficult circumstances.

However, impact funds have emerged as an anomaly. According to Pitchbook, 59.1% of impact funds were closed by fund managers raising their first, second, or third funds. Additionally, emerging managers accounted for 14.6% of total assets raised within the broader private capital landscape yet managed 17.7% of impact assets in 2023.

Read more: Nvidia’s AI Dominance: How Long Will This Bull Run?

Figure 1: Share of Impact Fund Count by Manager

Source: Pitchbook

Over the last decade, impact investing, which aims to generate financial returns alongside positive social or environmental outcomes, has gained significant traction. According to Phenix Capital, committed capital to impact funds now totals €589 billion ($629.25 billion), spread across more than 2,600 funds. There's been a notable shift towards sustainability and the integration of non-financial metrics into the investment philosophies of LPs. The demand for impact funds is poised to only strengthen further, with sustainability and impact identified as the second most sought-after focus areas for LPs, following healthcare, per Rede Partners’ Liquidity Index for 2H23. According to a survey by Mercer Investments, 50% of asset owners with $5 billion or more plan to increase their exposure to ESG/sustainability strategies.

However, these funds are still operating with a relatively new framework. Impact GPs haven't had the opportunity to establish extensive fund lineages or progress beyond a fourth fund. This novelty, thus, creates opportunities for emerging managers. First-timers like Vidia Equity, with €415 ($445) million raised for mid-market PE climate solutions, the Africa50 Infrastructure Acceleration Fund, investing $222.5 million in sustainable infrastructure, and Cross-Border Impact Ventures, with $90 million dedicated to women's and children's health, have seized the opportunity in the current market and emerged as formidable competitors to established impact managers like GEF Capital Partners, Ambienta, and Adenia Partners.

Read more: Level Up: The Resurgence of Video Game Startups in 2024

Additionally, there's a preference among impact-seeking LPs towards firms exclusively focused on impact, challenging the traditional belief that a reputable brand and extensive experience guarantee success. For example, TPG struggled to raise an impact fund comparable in size to its flagship PE funds. The third installment in the TPG Rise Fund series aimed for a target of $3.0 billion but closed at only $2.7 billion in November 2023. Similarly, Apollo sought to raise $1.0 billion to $1.5 billion for its inaugural Impact Mission Fund but achieved only the lower end of that spectrum, per Pitchbook.

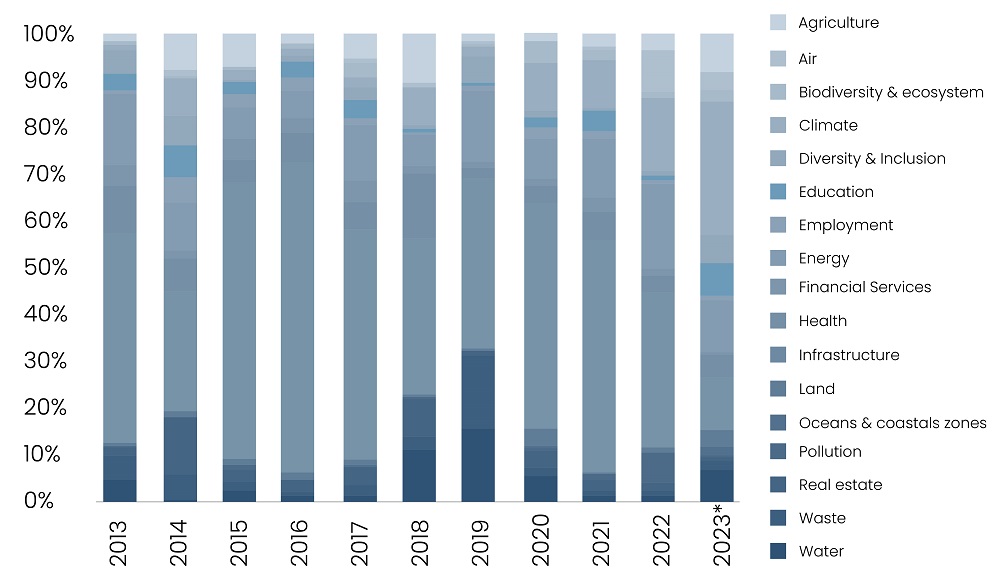

In line with the overall decline in PE fundraising in 2023, which hit a six-year low, impact fundraising experienced a significant drop of 70.8% from 2022, according to Pitchbook. However, the outlook for 2024 appears optimistic, offering additional momentum for emerging managers. This positive forecast stems from the surge of climate-focused pledges unveiled during the COP28 summit in December 2023, the realization of commitments outlined in the Inflation Reduction Act as well as the Infrastructure Investment and Jobs Act, and the growing number of corporate pledges to achieve net zero emissions. In line with these headwinds, climate has emerged as the dominant category in terms of capital raised. Over the past three years, investors have committed nearly $100 billion to funds that are at least partially dedicated to climate solutions, according to Pitchbook.

Figure 2: Share of Impact Capital Raised by Category

Source: Pitchbook

Read more: Rent Rolls to Red Flags: Regional Banks Face Growing Risks with Multifamily Loans

In conclusion, while fundraising for emerging managers has historically faced challenges, especially amidst the complexities of the previous year, impact funds have shown resilience, offering substantial opportunities for newcomers. With regulatory tailwinds and the increasing demand for sustainability-focused investments, the trajectory for impact investing remains promising. The outlook for 2024 appears optimistic, signaling continued opportunities for both established and emerging managers in the impact investment landscape.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.