Regional banks, particularly those with exposure to multifamily property or apartment building loans, are facing an impending problem. Financial challenges induced by high inflation and debt costs, limited credit opportunities, and increased insurance expenses and property taxes pose significant risks in the coming months.

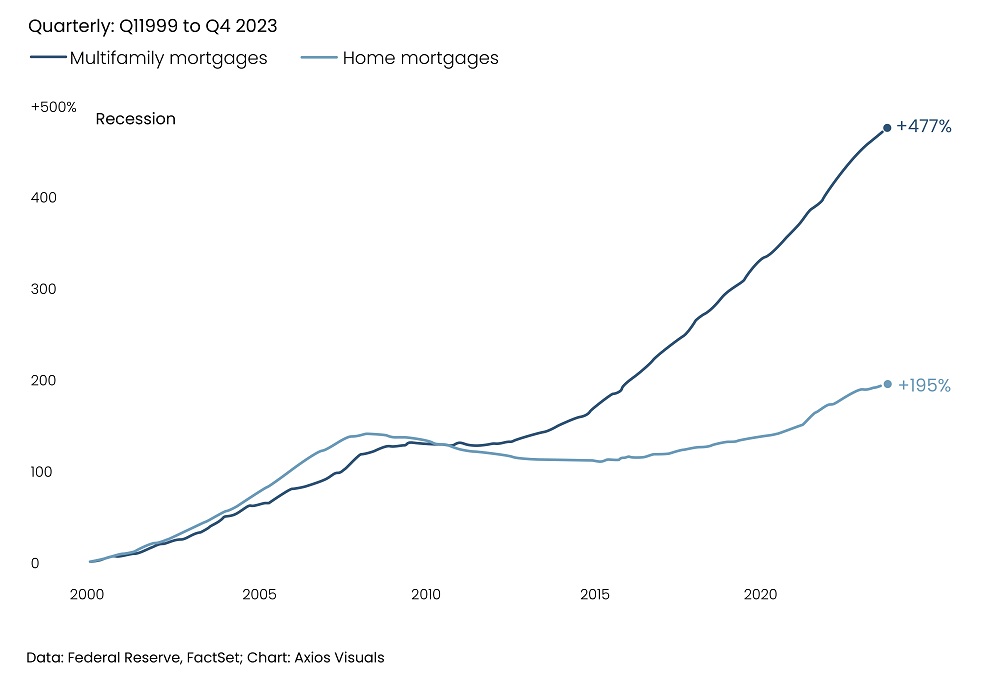

In the aftermath of the financial crisis, there was a notable surge in loans for apartment construction, with banks accounting for 40% of all lenders, according to the Mortgage Bankers Association. The decline in single-family home constructions led to increased demand for apartments and higher rental rates as Americans chose to rent for extended periods. This trend experienced significant growth for approximately 15 years, reaching its peak in 2021 and 2022, according to Axios. Additionally, the rising housing prices provided another reason to anticipate sustained demand.

However, the market has since experienced high inflation, an uptick in supply relative to demand, and significant increases in other expenses, such as insurance premiums. As we navigate 2024, the market anticipates distress, especially for borrowers engaged in negative-leverage deals. The sharp rise in interest rates poses a looming challenge as approximately $351.8 billion in apartment building bank loans are slated to mature between 2023 and 2027, with the vast majority needing to be refinanced, per Trepp.

Read more: Private Equity Outlook 2024

Figure 1: Growth of Select US Mortgage Debt Categories

Source: Axios

According to the National Multifamily Housing Council (NMHC), rent growth, though positive, hit its lowest point in six quarters at 4.5% in 1Q23, significantly below its peak of 15%. Concurrently, the average vacancy rate increased to 4.9% during the quarter, marking its highest level in six years. Meanwhile, over 1 million apartment units were reported to be under construction in the US, with developers projected to complete approximately 400,000 units, which is likely to surpass current demand. NMHC’s most recent quarterly survey unveiled that the indexes for market tightness, sales volume, and equity financing all fell below the breakeven level.

Multifamily loan delinquencies are expected to double this year to hit $1.3 billion, per Fitch. Moody’s Analytics noted the drop in the payoff to 71.7% in September which has consistently been in the range of high 80s and 90s throughout 2023. A report by Trepp indicates that around $23.5 billion of apartment loans possess a debt service coverage of less than 1, signifying inadequate cash flow to meet mortgage obligations. Veritas notably defaulted last year upon the maturity of a $447.5 million multifamily commercial mortgage-backed loan.

While certain metropolitan areas that faced challenges during the pandemic are now displaying resilience, others that previously had robust demand are showing signs of weakness, per Trepp. Its analysis revealed notable disparities in the share of high-risk multifamily loans across various US regions. For instance, New York witnessed a decrease in the percentage of high-risk loans but displayed an uptick in the delinquency rates. Phoenix, once a thriving market during the pandemic, is encountering challenges with declining rents and an overall vacancy rate of 9.3%, higher than the national average of approximately 6%, indicating potential risks on the horizon for these loans.

Read more: Prognosis 2024: Unveiling Healthcare Trends and Strategies

Confronted with maturing loans where property values do not support a refinancing option, banks are left with few alternatives. They may opt to extend maturing loans, anticipating appreciation in property values, or they might demand that borrowers inject additional equity into the deal. Another option would be foreclosure on the property as a last resort. New York Community Bank recently announced a 70% reduction in its dividend to enhance capital strength and increase its loss reserves, anticipating heightened distress in its substantial multifamily portfolio. KKR Real Estate Finance Trust Inc. lowered its dividend to 25 cents a share, down by 42% due to losses in office and multifamily loans, per Bloomberg.

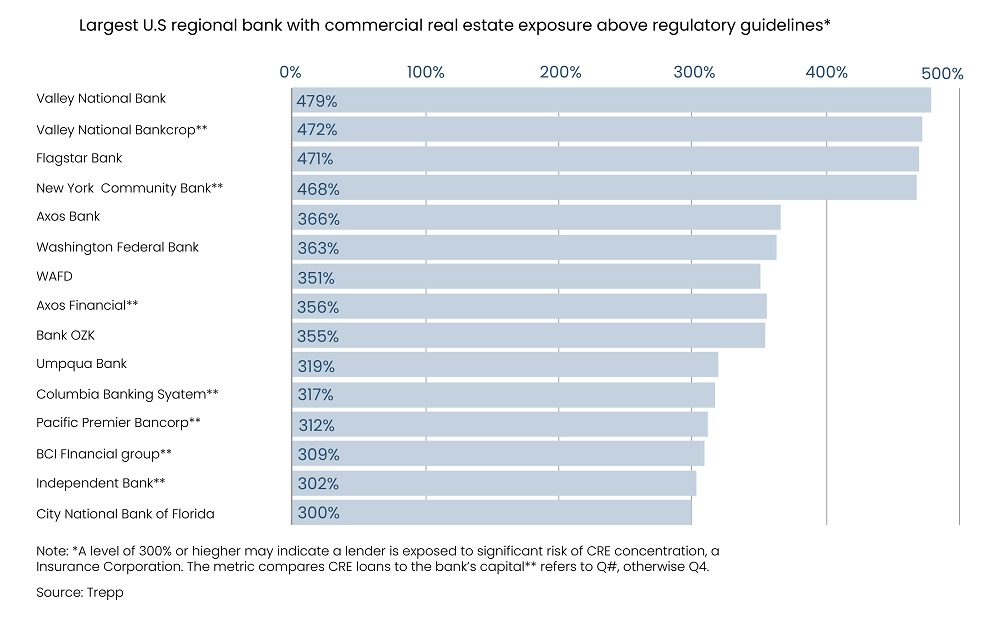

Figure 2: Commercial Real Estate Loans in Regional Banks

Source: Reuters

Read more: Savings Squeeze: A Looming Threat on the Economic Landscape

In conclusion, regional banks are navigating heightened risks associated with multifamily loans amid a challenging environment marked by high inflation, elevated debt costs, limited credit opportunities, and rising insurance and property taxes. The surge in rental growth and accessible debt in 2021 and 2022 spurred significant investment, but the landscape has shifted, leading to slowed growth, an uptick in loan delinquencies, and increased challenges in refinancing. This underscores the importance of enhanced monitoring and strategic decision-making in the current multifamily loan market.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.