The US economy's performance in 2023 was a testament to its resilience amidst challenging economic conditions. However, with rising debt levels, increasing credit card delinquencies, and the depletion of savings, the path ahead in 2024 appears cautious.

To sustain robust spending, households have been depleting their cash reserves in addition to increasing dependency on debt. In 4Q23, the personal saving rate decreased to 4%, from 4.2%, per the Bureau of Economic Analysis, while household debt climbed by 1.2%, per the Federal Reserve Bank of New York (FRBNY).

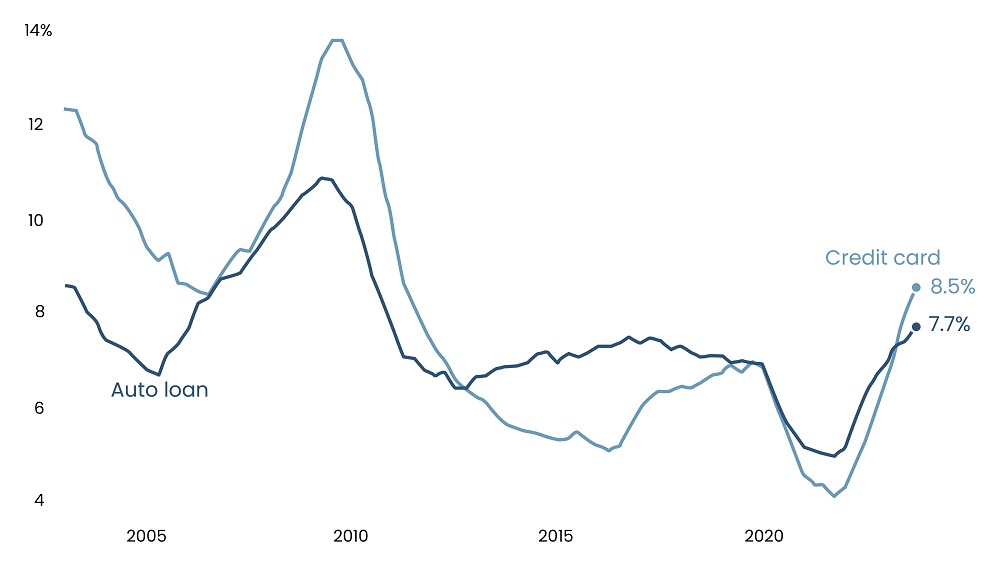

According to a report from the FRBNY, delinquency rates on credit cards & auto loans have surged to the highest levels owing to the financial crisis. In the 4Q23, total credit card debt surged to $1.13 trillion, marking a 4.6% increase from the preceding quarter. Credit card delinquencies spiked by over 50% last year, with a quarterly increase of 8.5%. Credit card debt transitioning into serious delinquency stood at 6.4% in 4Q23, reflecting a significant 59% jump from 2022.

These trends point to an elevated level of financial strain, notably observed among younger and lower-income households, raising concerns about the sustainability of increased spending patterns.

Read more: The Dragon's Dilemma: China's Path in a Shifting Global Landscape

Figure 1: Percentage of Balances Transitioned into Delinquency, Quarterly

Source: Axios

A closer examination of the situation reveals a logical explanation for the general decline in savings. The government distributed financial assistance to consumers during the pandemic, prompting a de-prioritization of personal savings. Before the onset of the pandemic, US consumers were building up savings at an annual rate of $1.28 trillion. In contrast, as of September 2023, this pace reduced to $690 billion.

Additionally, for the second consecutive quarter, consumer spending has outpaced income growth. Compounding this, inflation persists at elevated levels. Although inflation has cooled significantly, it remains well above the Federal Reserve's 2% target. Furthermore, when compared to 2021, prices have surged by 17.6%, according to FOX Business. The persistence of high inflation has imposed significant strains on most households, compelling them to allocate more funds for essential goods. As reported by FOX, food prices have surged by 33.7% since the beginning of 2021, shelter costs are up by 18.7%, and energy prices have risen by 32.8%. Moreover, the holiday season inherently elevated spending beyond normal levels. Wells Fargo remarked that the holiday spending observed last year served as a sort of final celebration for consumers before spending begins to moderate.

Read more: Venture Capital Outlook 2024

Looking ahead, saving rates are anticipated to return to their pre-pandemic levels. An analysis by First Trust Portfolios suggests that this normalization process may take around two years, potentially resulting in a reduction of consumer spending by approximately 1.5 percentage points per year. This adjustment could potentially decrease the pace of real consumer spending growth from 2.2% per year to less than 1.0% per year. Adjustments in spending are expected to be intensified by softer employment conditions, leading to a more subdued income momentum. Concurrently, the burden of cost fatigue is likely to exert pressure on consumer wallets in the early months of the year.

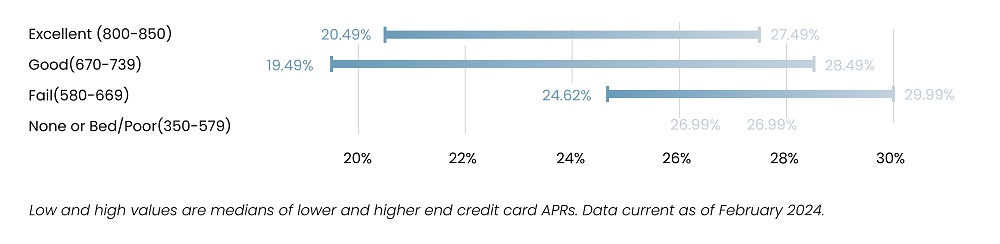

Spending performance is projected to be restrained in 2024. While the three rate cuts signaled by the Fed in the second half of the year are anticipated to offer some relief, the extent of their impact on debt remains uncertain. Notably, credit card rates currently hover at an all-time high average of 27.91%, according to Forbes, a significant increase from 16.34% in March 2022, per CNBC. According to Redfin, 2023 marked the least affordable homebuying year in at least 11 years due to elevated mortgage rates. The Fed cuts are expected to alleviate the exceptionally high rates but may not return them to pre-pandemic standards. On a positive note, top-yielding online savings account rates are now surpassing 5%, the highest in nearly two decades, compared to around 1% in 2022, as reported by Bankrate. These elevated rates are expected to persist, encouraging savings.

Read more: 2024 Macroeconomic Outlook: Unpacking Economic Trends

Figure 2: Available APRs by Credit Score

Source: Investopedia

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.