The Fed’s rising interest rates since early 2022 to combat high inflation had fostered pessimism within the economy. However, the year 2023 demonstrated the resilience of the markets. Despite formidable challenges such as elevated interest rates, stringent bank lending norms, and a manufacturing sector deceleration, the global economy exhibited commendable expansion.

In the unfolding landscape of 2024, pivotal forces like the generative AI revolution, the low-carbon transition, demographic shifts, the future of finance, and geopolitical changes present significant investment prospects. Private markets stand strategically poised to capitalize on the ongoing transformations, leveraging their unique positioning.

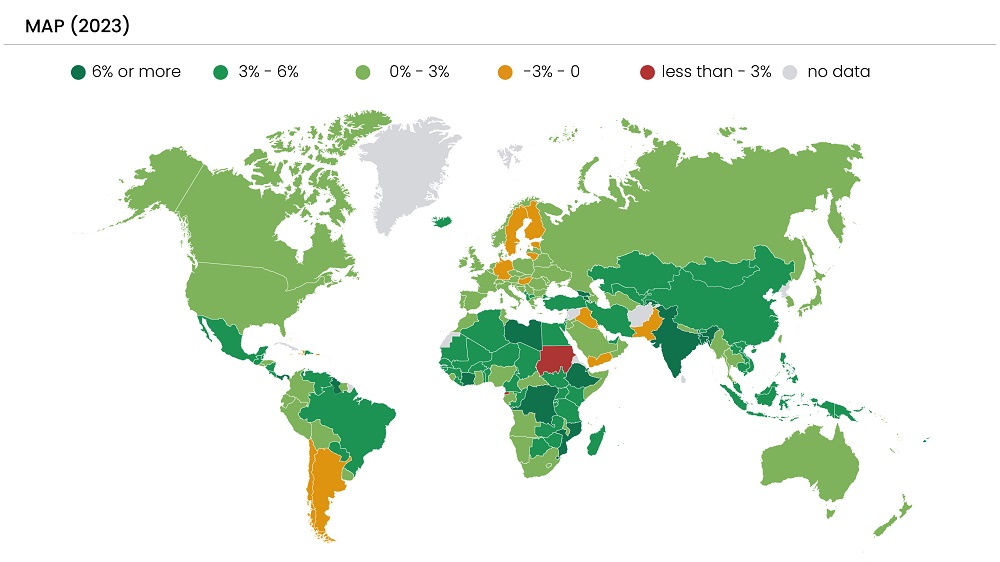

Inflation and Gross Domestic Product (GDP)

The Consumer Price Index (CPI) fell from a four-decade high of 9.06% in June 2022 to 3.1% in November 2023, per Ycharts. This moderation is primarily fueled by the Fed’s aggressive monetary policies coupled with a reduction in energy prices. Moreover, price indices for used cars and trucks, lodging away from home, communication, and airline fares also experienced moderation. Real GDP increased at an annual rate of 5.2% in 3Q23, the fastest quarterly growth in nearly two years. This acceleration in growth is primarily ascribed to an upturn in consumer and government spending, private inventory investment, business spending on facilities, and exports. Consumer spending rose at a 3.6% annual rate in 3Q23, and private investment surged at a 10.5% annual pace, including a 6.2% increase in housing investment, which defied higher mortgage rates.

Read more: Insurance Assets Emerge as Preferred Strategy for Private Equity.

Figure 1: Real GDP Growth in 2023

Source: International Monetary Fund

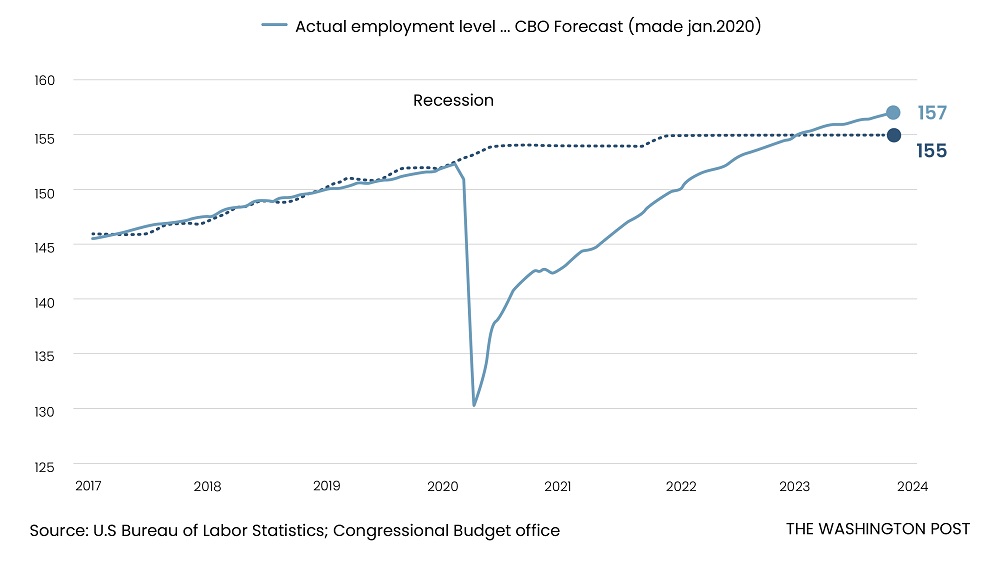

Labor Market and Wages

The labor market is one of the key areas outperforming expectations. Overall employment is two million higher than the pre-pandemic forecasts made by the Congressional Budget Office. The unemployment rate, at 3.7% in November, has stayed below the four percent threshold for two consecutive years, empowering workers to demand raises and switch to better jobs. According to the US Bureau of Labor Statistics, 199,000 new jobs were added in November, a decline from the 400,000 added monthly last year. However, the slowing growth of the labor market has been a welcome change to cool off inflation.

Figure 1: The Economy has Two Million More Jobs Today than Predicted in Pre-Pandemic Forecasts

Source: The Washington Post

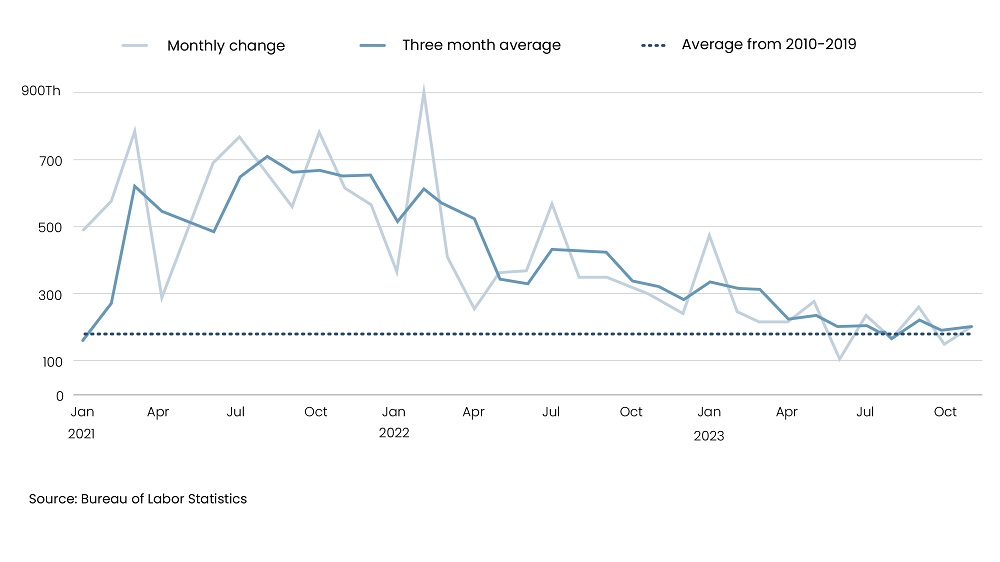

Wages have been on an upward trend since 2021, contributing to the inflationary pinch experienced in recent years. In November, the annual increase in wages stood at 4%, still rising too rapidly to lower inflation to the Fed’s target of 2%. According to Reuters, US payrolls grew by 183,000 per month on average from 2010 to 2019. Post-pandemic, the employment boom pushed this average up, but this growth has been gradually slowing and is ebbing back towards pre-pandemic levels.

Read more: Private Investments to Bridge the Climate Funding Gap

Figure 2: Payroll Growth Reverts to Pre-Pandemic Trend

Source: Reuters

Looking Ahead to 2024

With inflation cooling and hiring remaining strong, prospects for a soft landing have risen. In the recent Federal Open Market Committee (FOMC) meeting, the committee stressed its commitment to bring inflation down to its two percent goal and emphasized the necessity of restoring price stability to achieve and maintain strong labor market conditions. To this end, the FOMC decided to keep benchmark interest rates unchanged but signaled three cuts in 2024. The eventual cuts and normalization of interest rates will boost consumer confidence and instill optimism within the economy. Future interest rate declines will cause a ripple effect with businesses and consumers planning previously halted expenses and providing the required boost to the economy.

There is consensus among several organizations that GDP growth is expected to continue a similar trajectory as this year, however, at a subdued rate between 1.5 to 2.1%. Organization for Economic Co-operation and Development projects GDP growth in the United States to be at 1.5% in 2024 and then picking up slightly to 1.7% in 2025 as monetary policy eases up. Goldman Sachs expects GDP to grow 1.8% in 2024 on a Q4/Q4 basis or 2.1% on a full-year basis. JP Morgan forecasts a below-trend 0.7% pace of expansion in 2024 to 2.8% real GDP growth in 2023.

Read more: Investment Outlook: Private Equity Market Trends 2023

Consumer spending is likely to rise because of tight labor markets to support employment and sustained income levels. However, this growth is expected to be at a muted pace in comparison to 2023 on account of diminished excess savings, plateauing wage gains, low savings rates, and less pent-up demand. Additional avenues of stress for consumers include the resumption of student loan payments and an uptick in subprime auto and millennial credit card delinquencies.

Momentum in the job market has started showing signs of dampening with slowed payroll and additional employment growth. While recent headlines about union wage demands have sparked concern about a reacceleration, the wage hikes have not been of significant magnitude, and unionized workers’ wage growth rate is a lagging indicator due to the longer-lasting nature of their contracts. Increased labor force participation and elevated immigration patterns observed over the past year have further added to the labor supply, while businesses remain reluctant to cut their workforce, resulting in reduced hiring activity. The FOMC projects the US unemployment rate will average a healthy 4.1% in 2024, well below its long-term average of around 5.7%.

A major obstacle in achieving the desired soft landing is increasing geo-political risk. Heightened trade tensions with China, the ongoing Ukraine-Russia war, and rising conflicts in the Middle East add to the uncertainty of the upcoming year. While the economy has resisted direct impact, going forward, the larger uncertainties and risks associated with global supply chains and production systems, especially for critical commodities, can disrupt the domestic markets.

In conclusion, the US economy has not only quelled fears of recession in 2023 but has also made substantial progress in delivering robust growth. Looking forward to 2024, we can expect cuts in the 22-year high-interest rates, further GDP growth, and increased consumer spending with moderation in the labor market activity.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.