The SEC recently adopted new regulations aimed at enhancing and standardizing climate-related disclosures by public companies, thereby fostering greater transparency in the carbon credit market. Recognizing the potential in the burgeoning demand for high-quality credits, several PE firms have ventured into this market. This regulation is expected to further increase demand for high-quality credits and other ESG commodities, broadening opportunities for these firms.

PE’s entry into the offsets market is driven by two primary factors.

First, PE firms recognize that emission trading systems (ETSs) and carbon credits, more generally, are in nascent stages, representing robust growth prospects. According to the World Bank, the proportion of global emissions covered by either a carbon tax or an ETS was 23% in 2023, a pronounced jump from 7% merely a decade ago. And, with 77% of global emissions currently falling outside the purview of any carbon credit scheme, there is significant room for growth, increasing the segment’s attractiveness to investors. Additionally, the Global Infrastructure Hub reports that around one-fifth of the world's 2000 largest companies have pledged to achieve net zero emissions by the year 2050 in 2022, which equates to buyer demand for 1.7 billion tons of carbon credits. The report forecasts corporate demand to escalate astronomically in the near future, driven primarily by the establishment of more net-zero targets.

Read more: Rent Rolls to Red Flags: Regional Banks Face Growing Risks with Multifamily Loans

Second, there is a significant and unmet demand for high-quality credits with verifiable mitigation benefits, posing an opportunity for PE to step in and address the market. This is because the still-inchoate voluntary carbon market suffers from a lack of standardization and, consequently, an opacity in credit quality. Quality within this market refers to the assurance that a credit effectively offsets one ton of carbon dioxide. A high-quality credit is rigorously tied to durable and measurable emissions reduction or carbon removal. Conversely, lower-quality credits lack valid verification and evidence. As a result, cheaper, low-quality credits often yield minimal to no positive climate impact, exposing companies to accusations of greenwashing. This has fueled an increase in the demand for high-quality credits, which in turn has driven up their prices, according to BeZero Carbon. The growing market preference for quality assurance, evident from credits rated BBB or higher being retired at higher rates than those rated BB or lower, is providing a robust incentive to PE firms to enter the business of high-quality carbon credits.

Most notably, Bain Capital has invested in Terra Natural Capital, a New Jersey-based investment firm that finances offset-generating projects; Stafford Capital Partners is raising a fund to invest in forest projects to generate about 30 million carbon offsets; Private Group has earmarked 10-30% of its Royalties fund to carbon credits generation projects. The SEC’s recent regulation is only bound to accelerate the trend of PE’s entry into the space.

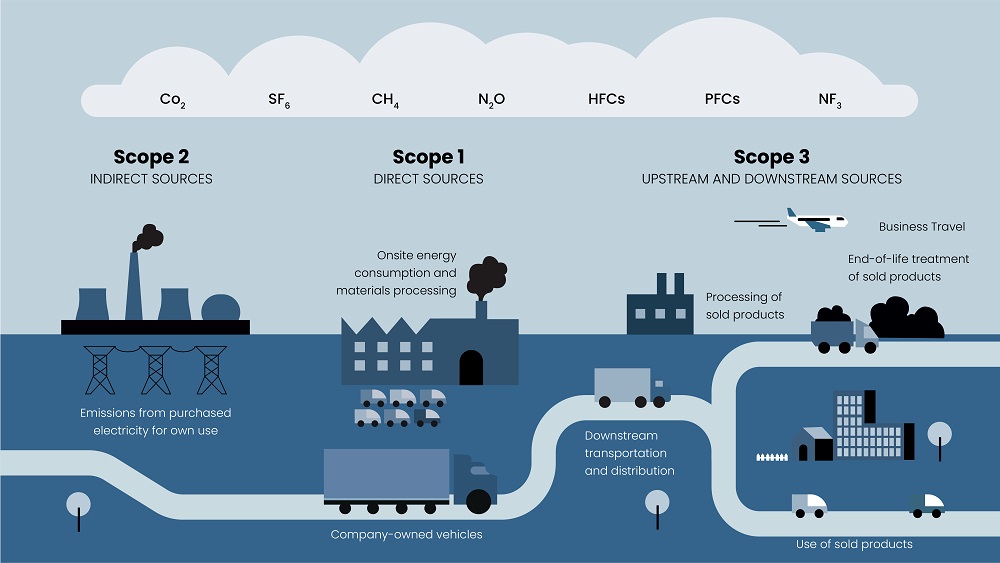

Figure 1: Scope 1-2-3 Emissions

Source: OliverWyman Forum

Read more: Navigating the Roadblocks: The Path Ahead for Robotaxis

The SEC's long-awaited climate disclosure rules, mandating scope 1 & 2 greenhouse gas emissions disclosure for publicly traded companies, aim to provide investors with comprehensive insights into the climate and energy transition risks faced. Companies will need to ensure that they establish the necessary systems and implement compliant governance structures to adhere to these regulations. The SEC is phasing in the new rules gradually, with the initial deadline slated for fiscal year 2025.

The finalized rules do not encompass scope 3 disclosures, which would have necessitated public companies procuring emissions data from private entities within their supply chain. However, this omission does not exempt private markets from the impact of this regulation. Firstly, any company contemplating or aiming to go public will need to establish systems to comply with reporting requirements, increasing the burden of public listing. Secondly, numerous private fund managers, including Blackstone, KKR, The Carlyle Group, Apollo, and Ares, are themselves public companies subject to SEC oversight. However, the SEC’s regulation is also expected to have positive effects on private entities. Private debt funds are increasingly involved in extending loans to public companies. The mandatory inclusion of material climate risks in the annual reports and SEC filings of borrowing companies provides these debt funds with a welcome additional resource in their due diligence process for borrowers.

Read more: Google Search and Generative AI: Navigating the Paradigm Shift

The new SEC regulation, by serving to enhance transparency in the market, is expected to have the knock-on effect of creating a rise in demand for high-quality carbon credits from firms obligated to make these disclosures. PE firms currently involved in the credit market are well placed to benefit from this surge in demand, while others are expected to enter the market to meet this growing demand.

As climate change becomes an increasingly concrete reality, policymakers will only get more proactive with carbon taxes and ETSs. Already, the Biden administration has made abating the country’s emissions a matter of national priority, channeling billions of dollars into loans and grants to enterprises dealing in clean energy. Across the pond, the sweeping legislation passed by the European Union in 2022, mandating disclosures regarding scope 3 emissions, indicates the future direction of climate-related regulation. The global carbon credit market, valued at US$978.56 billion in 2022, is expected to reach US$2.68 trillion by the year 2028 at a CAGR of 18.23%. The demand for high-quality carbon credits—and consequently, the demand for PE firms in the carbon market—is only poised to increase.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.