Robotaxis, which aimed to transform urban transportation, faced significant skepticism in recent months due to regulatory headwinds, operational issues, and a decline in public trust. Nevertheless, this technology has a long-drawn incubation period and is poised to surmount short-term hurdles, ultimately unlocking its potential to become a trillion-dollar industry.

Over the last decade, investments in global robotaxis, robot shuttles, and robot trucks have totaled nearly $42.5 billion, per data from research firm Yole Group. However, investors now appear rattled due to the prolonged return timelines. This unease has been exacerbated by setbacks in the industry, including the withdrawal of Cruise, the implementation of stringent legislation in the UK, and a series of reported accidents and operational issues. The most recent development is Aptiv, an Irish automotive company, discontinuing capital support for Motional, a Boston-based autonomous automaker. Concurrently, per TechCrunch, Apple is abandoning its secretive and long-running autonomous electric car project.

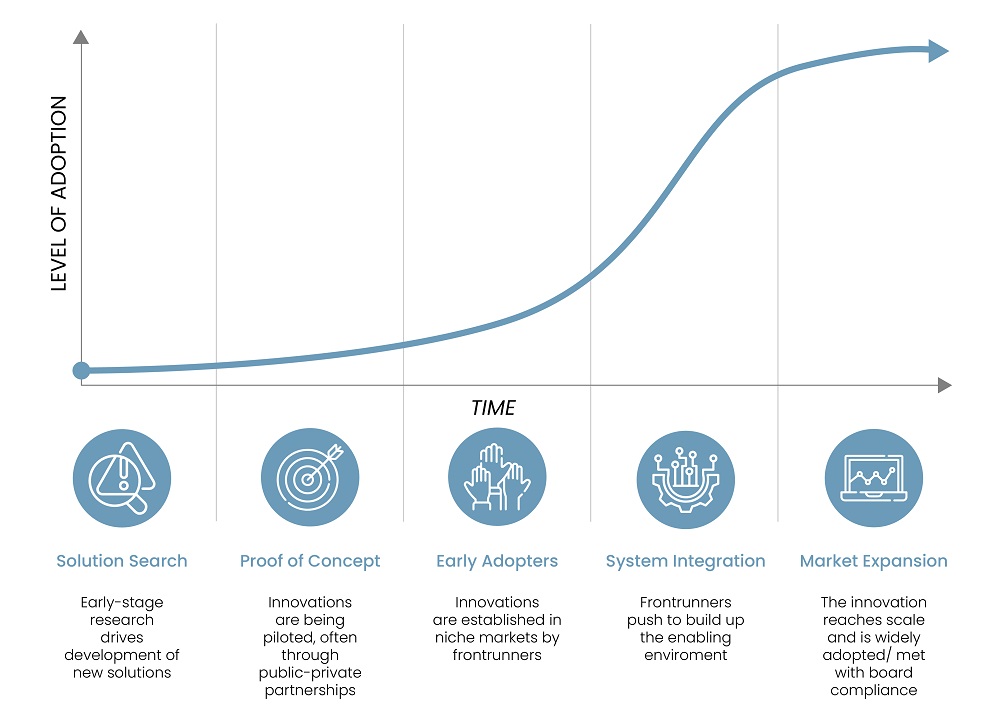

The global robotaxi market is projected to experience an extraordinary CAGR of 91.8%, expanding from $0.3 billion in 2023 to $47.5 billion in 2030, according to MarketsandMarkets. The complex and multi-stage process of developing and commercializing robotaxis is expected to follow a positive S-curve adoption trajectory. This process can be broadly summarized in three stages. First, technical feasibility demonstrations to validate safe and reliable operation under targeted conditions. Second, technology optimization, integration, and refinement of vehicle design to facilitate scalability in manufacturing and deployment. Third, efficient expansion into new locations and operating conditions.

Read more: Nvidia’s AI Dominance: How Long Will This Bull Run?

Currently, the majority of robotaxi operators are navigating through the first stage, while a few are striving to achieve scale in the second stage. Geofencing will be rigorously applied to robotaxis for the foreseeable future, restricting revenue services to specific areas extensively tested for operation. S&P Global predicts that widespread adoption of autonomous technology is at least a decade away. Despite the prolonged incubation period in commercializing robotaxis, there had been optimistic short-term growth forecasts, which contribute to skepticism when these expectations are not met.

Figure 1: Mass-market Adoption S-curve

Source: RMI

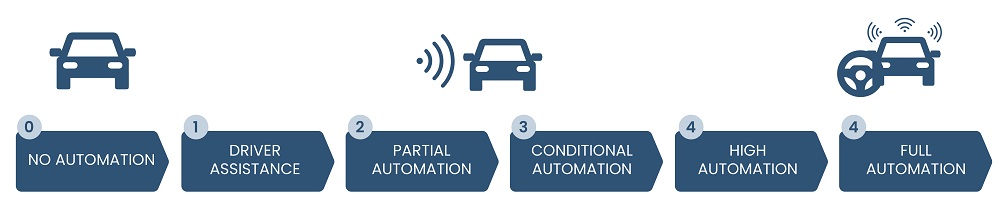

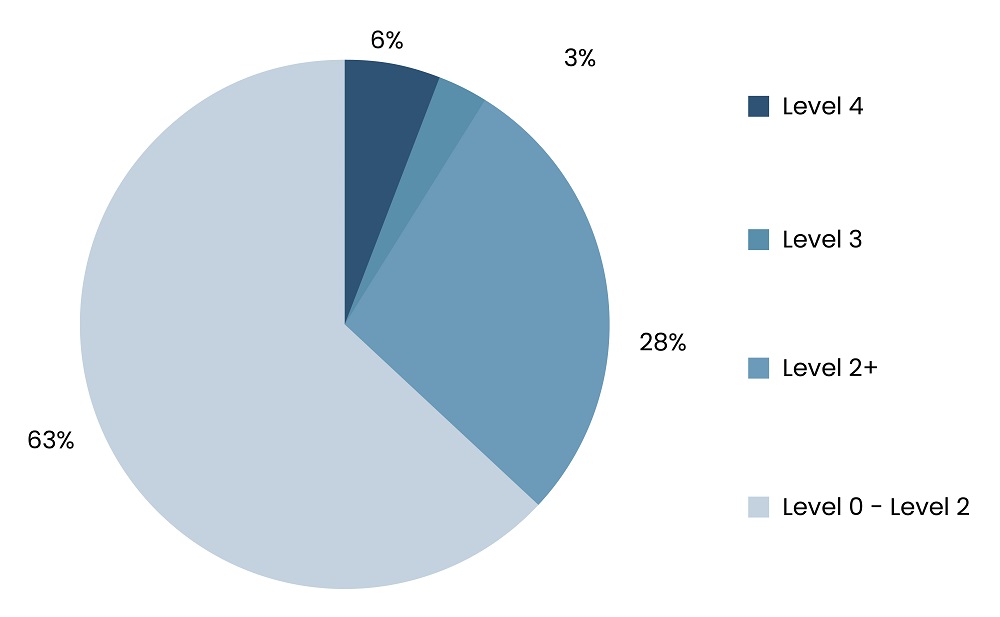

Autonomous vehicles, while holding the promise of revolutionizing urban transportation, are still in their infancy. According to S&P Global, the industry's primary focus now remains on automated, rather than fully autonomous, driving. The widespread deployment of Level 2+ and 3 systems is anticipated to constitute at least 31% of new vehicle sales globally by 2035. Although fewer than 6% of light vehicles sold in 2035 are expected to possess Level 4 functionality, the majority of this segment will be comprised of MaaS robotaxis, reaching approximately 800,000 vehicles globally.

Figure 2: Levels of Vehicle Autonomy

Source: Ptolemus

Figure 3: 2035 Global Light Vehicle Sales by Autonomy

Source: S&P Global

Read more: Level Up: The Resurgence of Video Game Startups in 2024

In order to realize its projected long-term capabilities, the landscape must adapt to meet the specific needs of robotaxi technology. Initially viewed as a potential solution to traffic congestion and road safety, recent disruptions indicate that robotaxis might unintentionally exacerbate the issue. Presently, urban transportation infrastructure lacks the capacity to accommodate the technological demands of robotaxis, as it was originally designed for conventional manual transport. However, it is expected to undergo evolution in the coming decade to better align with the advancing technology. China recently opened its first intelligent expressway, which was designed specifically for fully autonomous driving.

The industry's growth is currently hampered by substantial regulatory headwinds. These challenges arise partly due to insufficient infrastructure and partly due to operational shortcomings among service providers. Notably, in California, recent legislation presented in the state Senate empowers city and county governments to enforce more stringent limitations and regulations on robotaxi services than those mandated by state agencies. Additionally, existing federal regulations impose a cap of 2,500 vehicles per company for the testing of autonomous vehicles. The regulatory framework within the industry is still evolving as policymakers strive to find an optimal balance for effective operations.

Moreover, robotaxis currently faces challenges in competing with traditional taxis, particularly in terms of pricing and assured safety. These companies find themselves in competition with Uber drivers, who often operate mid-priced vehicles and handle maintenance independently. In contrast, robotaxis are equipped with expensive technology which requires continuous monitoring and occasional human intervention. As the technology reaches higher levels of adoption and scales their services, robotaxis will be able to unlock their true potential and effectively compete with ride-sharing services.

Read more: The Dragon's Dilemma: China's Path in a Shifting Global Landscape

Robotaxis holds the potential to transform the urban transportation landscape by offering a more affordable, safer, and efficient alternative that saves time. Over the past decade, investors have acknowledged this potential and heavily invested in startups with optimistic short-term growth expectations. However, recent disruptions in the industry have rattled these expectations. It's essential to recognize that the technology behind robotaxis inherently requires a more extended incubation period, undergoing fine-tuning before achieving widespread commercialization. Furthermore, the overall environment for robotaxis, including infrastructure, regulations, and pricing, needs to evolve to create an optimal setting for industry to unlock its trillion-dollar potential.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.