Nvidia, at the heart of the AI revolution, is almost synonymous with its progress. As of 21st February 2024, it is the world's fourth most valuable company, having solidified its monopoly in the AI hardware value chain. However, the prospect of this bull run being sustained over the long term appears thin, with growing competition and an evolving landscape.

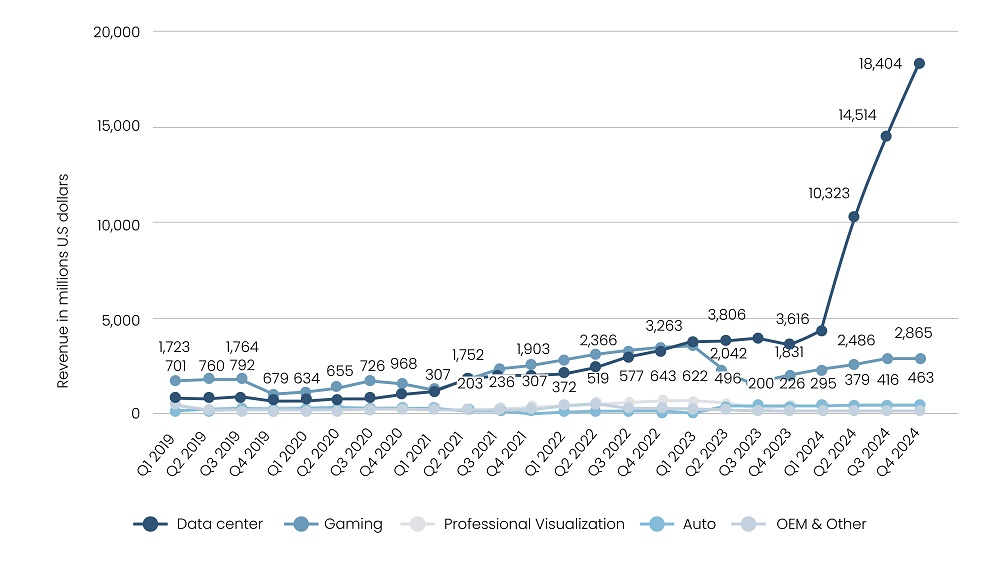

Nvidia’s recently released earnings report for 4Q23 highlighted that its data center division, crucial for powering AI initiatives across numerous organizations, contributed significantly to its growth. The division’s revenue reached $18.4 billion—a remarkable 409% rise year-on-year.

Figure 1: Nvidia Specialized Market Revenue, Quarterly

Source: Statista

Read more: Private Equity Outlook 2024

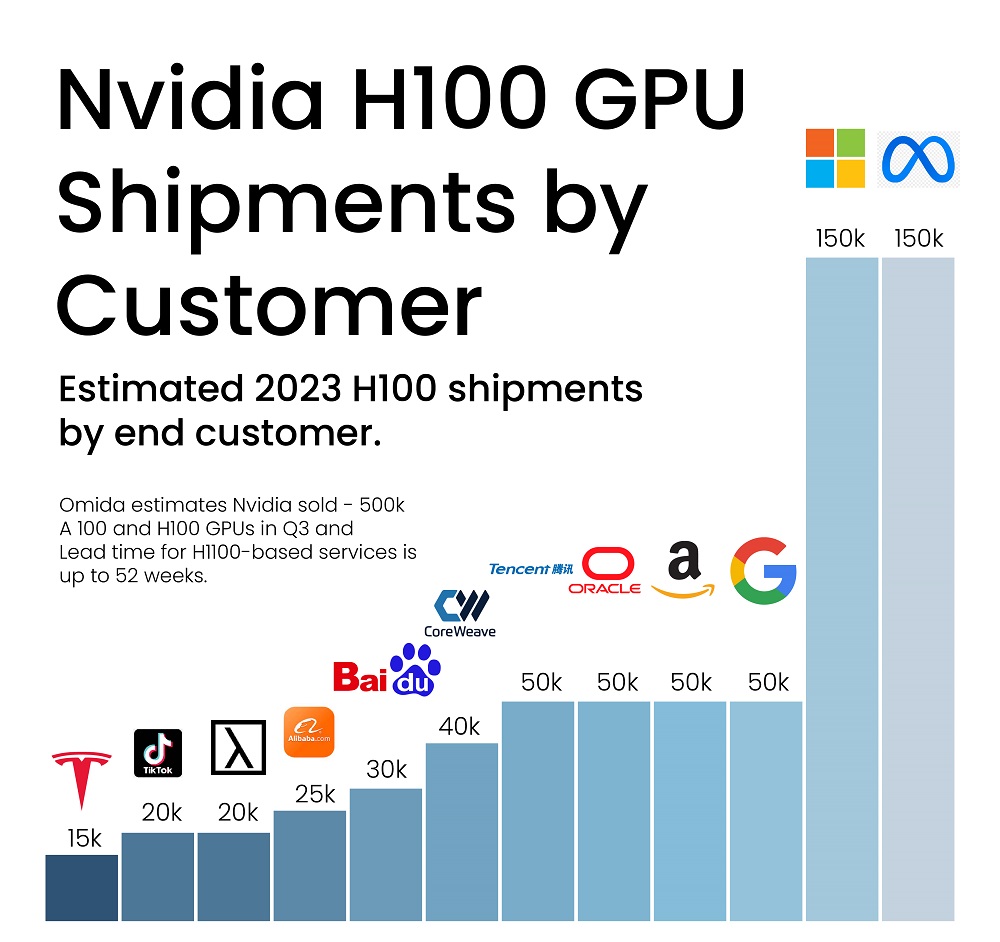

Currently, the company is at the forefront of developing the H100 chip, a powerhouse that drives the majority of LLMs in operation. According to CB Insights, Nvidia captures approximately 95% of the GPU market for machine learning, boasting over 40,000 companies relying on its GPUs, including OpenAI, and a substantial share of AI projects by Microsoft, Meta, and Amazon. The company reported a remarkable 1,000-fold improvement in AI inference performance over the past decade and remains dedicated to enhancing its chips for increased efficiency and cost-effectiveness, ensuring a competitive edge in the market.

Besides maintaining competitiveness in the industry, Nvidia is actively broadening the ecosystem by enhancing current capabilities. As reported by Reuters, the company has injected $30 billion into a specialized unit aimed at assisting other companies in developing their custom AI chips. This strategic move is twofold: first, by encouraging companies to create their own AI chips, they can achieve resilience and self-sufficiency in their operations. Second, from Nvidia's perspective, this initiative allows them to assert influence by setting competitive terms while securing a percentage of the proceedings.

The crucial question looming, however, is whether the remarkable surge in the company's success is sustainable. The current frenzy around AI and the global shortage of advanced processors have elevated the value of Nvidia's products. However, this premium is more likely to diminish than endure. Startups such as SambaNova, Cerebras, and Groq have emerged as formidable challengers to Nvidia's dominance. Groq, for instance, employs language processing units that are highly specialized in AI inference, reducing reliance on GPUs. This specialization allows Groq to assert faster delivery of LLM output, showcasing a potential shift in the hardware value chain.

Read more: Prognosis 2024: Unveiling Healthcare Trends and Strategies

While AI is fueling the demand for Nvidia’s products, it is also contributing to expediting the chip manufacturing process. Software companies like Cadence and Synopsys, for instance, are leveraging AI to automate aspects of chip design and ease the process of switching manufacturers as alternatives emerge.

Furthermore, a significant threat to Nvidia lies in the concentration of sales to a limited number of customers. Amazon, Meta, Microsoft, and Google, Nvidia's largest customers, account for approximately 40% of its revenue. Going forward, the company's sales could face adverse effects if these customers decide to reduce their product purchases, opt not to integrate Nvidia's products into their ecosystems or modify their purchasing patterns in the future.

According to Bloomberg, Nvidia's sales of AI chips predominantly stem from the very companies involved in the chips race. Recently, Open AI CEO Sam Altman gained widespread attention by seeking up to $7 trillion for the development of silicon-chip manufacturing capacity. Concurrently, Microsoft has forged a strategic partnership with Intel to manufacture chips. Over time, as its customers become more self-sufficient, Nvidia's business model is likely to face challenges.

Figure 2: Nvidia GPU Shipments by Customer

Source: Omdia Research

Read more: Savings Squeeze: A Looming Threat on the Economic Landscape

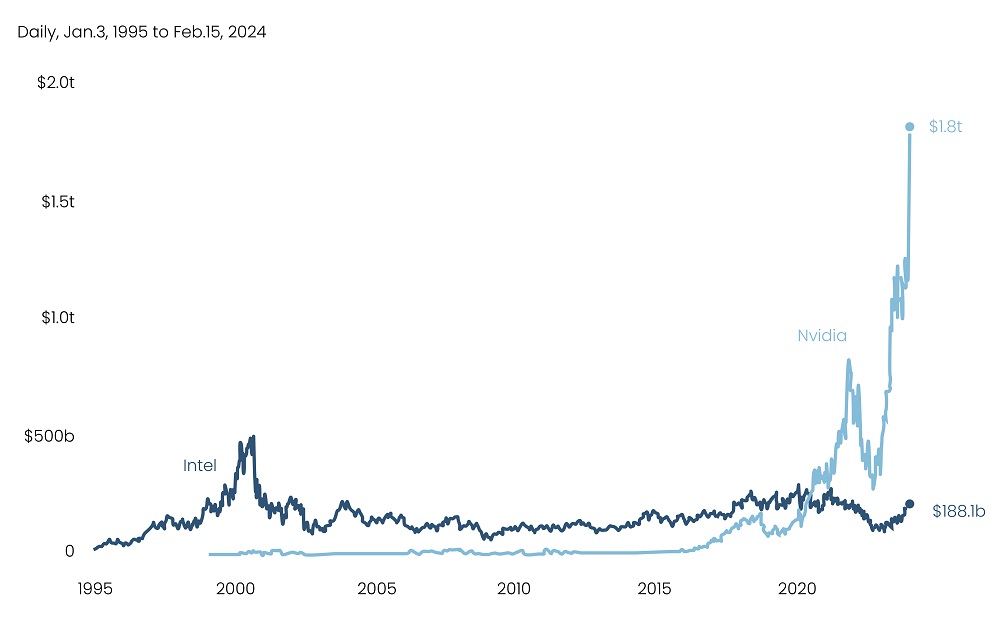

Meanwhile, Intel and AMD, direct rivals of Nvidia, are striving to enhance their chip technology but still lag far behind Nvidia in terms of market valuation. Intel, once the forefront leader in microchips, now holds a market value of less than $0.2 trillion. However, the company has recently identified opportunities in the domestic market and is making efforts to transform itself into a contract manufacturer, competing with Taiwanese and Korean counterparts. While many US companies design chips, the majority depend on Taiwan Semiconductor Manufacturing Co. or Samsung to manufacture their cutting-edge chips, a dependence considered geopolitically precarious. In addition, Intel has forged a partnership with Microsoft in support of this endeavor.

Figure 3: Nvidia and Intel Market Value

Source: Axios

In conclusion, Nvidia has emerged as a prominent success story in the AI ecosystem, showcasing technological expertise, creating strategic partnerships, and maintaining a competitive edge. However, with the industry becoming more competitive and major players vying for a share of the AI chip market, Nvidia faces challenges to maintain its virtual monopoly. The sustainability of its success is questioned, considering the dynamic nature of the industry and the potential erosion of the premium on its products. In this evolving landscape, Nvidia’s future hinges not only on technological innovation but also on its ability to adapt to market dynamics and sustain customer relationships in the growing competition.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics, provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.