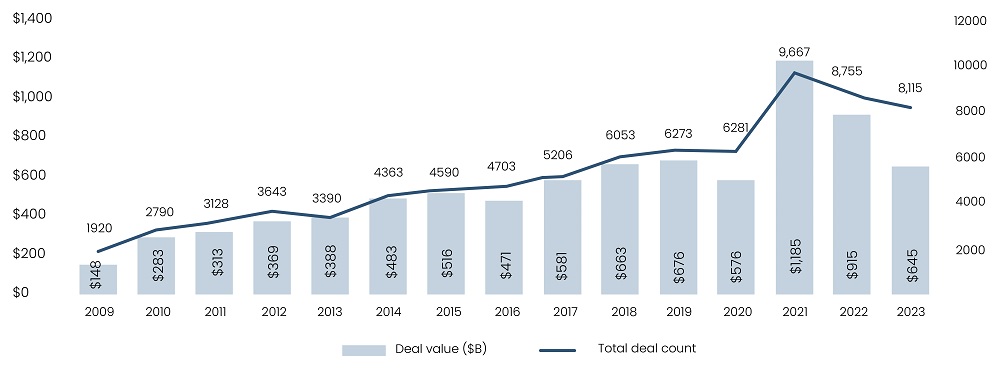

In 2023, global macroeconomic and geopolitical pressures significantly affected private equity (PE) activity. The implementation of a more stringent monetary policy to combat high inflation and the subsequent rise in interest rates led to a contraction of private equity deal value by 54.7% and deal count by 34% during 3Q23, compared to its peak in 4Q21, per Pitchbook. Additionally, the year witnessed a fundraising slowdown, with the total fund count declining by 51% from 779 in 2022 to 381 in 2023, as reported by Pitchbook. While this decline is seemingly precipitous, it reflects the market’s recalibration to its pre-pandemic baseline following a period of heightened activity. Despite the unprecedented levels of dry powder – $2.59 trillion in 1H23, according to S&P Global – investors have remained cautious, awaiting reductions in asset valuations to reflect cooler demand and tighter financing. Conversely, sellers have been extending holding periods to maximize their exit values.

Figure 1: US PE Deal Activity

Source: Pitchbook

However, a closer look at the performance of last year’s macroeconomic indicators paints a more optimistic picture. Although muted in comparison to the post-pandemic surge, the US economy displayed robust growth. Core inflation has fallen sharply, with the annual rise in the Consumer Price Index falling from a four-decade high of 9.06% in June 2022 to 3.4% in its December reading. Real Gross Domestic Product registered a noteworthy annual growth rate of 4.9% in 3Q23, marking the fastest quarterly expansion in nearly two years. As of December 2023, the unemployment rate stood at 3.7%, consistently remaining below the 4% threshold for two consecutive years, with the annual wage increase at 4.1%. While the markets navigate the delicate balance between the hope for a soft economic landing and concerns about escalating inflation, private equity activity in 2024 is poised to undergo adjustments due to this structural shift toward slower growth and increased volatility.

Read more: Savings Squeeze: A Looming Threat on the Economic Landscape

Investment Climate Will Remain Unchanged in the Medium Term

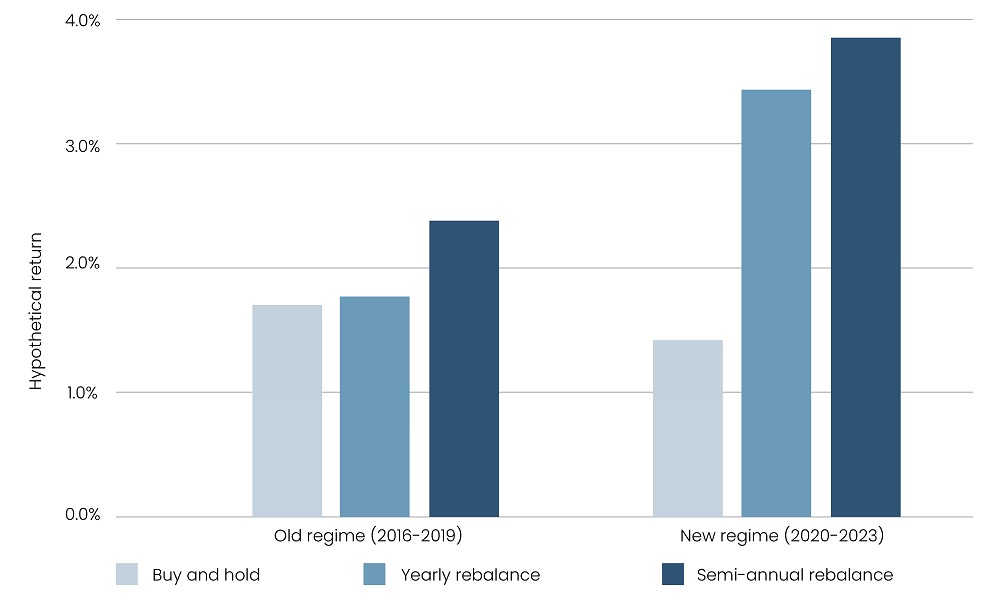

The current investment climate – characterized by elevated inflation, costly credit, and a deceleration in deal flows – is expected to persist, at least in the medium term. Following the recent Federal Open Market Committee meeting, the committee opted to maintain benchmark interest rates at their current levels for the future but signaled three cuts in 2024. Optimizing portfolio outcomes amid increased volatility and dispersion will necessitate an active and adaptive approach. According to Blackrock’s hypothetical return data (see Fig. 2), adopting a more dynamic investment strategy is projected to outperform a traditional buy-and-hold approach.

As market participants adjust to this new reality, more distinctive and sustainable investment strategies are anticipated to come to the forefront. Given the challenging credit environment, even larger firms are encountering difficulties in financing large-scale acquisitions at feasible rates. A study published in Finance Research Letters indicates that non-mega deals tend to exhibit better short-term performance. In the current volatile climate, smaller deals continue to present opportunities for investors to capitalize. Another strategy expected to gain popularity involves acquiring minority stakes in target companies. This approach grants investors access to superior risk-adjusted return opportunities, including liquidation preferences, earn-outs, and seller notes. Additionally, it provides entry to robust and scaled companies with well-established management teams, all while facing reduced buy-side competition.

Read more: Prognosis 2024: Unveiling Healthcare Trends and Strategies

Figure 2: Hypothetical Impact of Rebalancing on US Equity Returns

Source: Blackrock

Private Credit Investment Strategies Will Take the Limelight

In recent months, the credit market witnessed a retreat from traditional bank lenders due to rising interest rates, the fallout from the US regional bank failures, the resulting tightened standards for lending, and a decline in deposits. Against this backdrop, private equity funds are shifting their focus toward private credit as an alternative avenue. According to a Mergermarket and Dechert LLP report, 78% of the private equity managers surveyed indicated that their funds utilize private credit for acquisition financing at the portfolio level. Additionally, 73% of those whose firms do not currently have a private credit investment strategy are contemplating adding one to their offerings. With traditional lenders stepping back, surging demand for private credit, and opportunities for portfolio diversification and risk mitigation abounding, the market is witnessing a rush of private equity managers. Apollo’s private credit unit, for instance, now manages over $400 billion, surpassing the $100 billion in assets under management in its buyout division, historically the cornerstone of the group’s business. Blackstone recently merged its credit and insurance arms, which together manage $295 billion, i.e., more than double the $137 billion in its private equity business. The firm aims to achieve a growth target of $1 trillion in the next decade.

Read more: Shifting Strategies: Venture Capital’s Shift to Secondary Markets

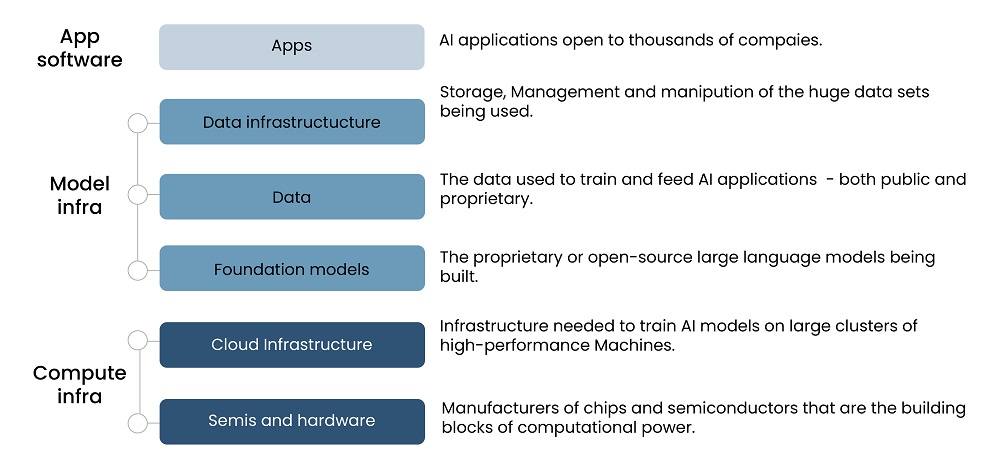

Investment and Integration of Artificial Intelligence (AI) will Emerge as the Key to Growth

The potential of AI in 2024 presents a dual opportunity. On the one hand, investments in AI technology are expected to advance exponentially as innovation snowballs. This expanding investment opportunity is not only restricted to application software and technology but across the ecosystem to semiconductors, hardware, cloud infrastructure, foundation models, etc. According to S&P Global, private equity and venture capital firms worldwide had announced $10.34 billion of investments across 342 transactions in the AI and machine learning sector in just the first half of 2023. With the global AI market poised to grow from $150.2 billion in 2023 to $1345.2 billion in 2030 at a CAGR of 36.8%, the momentum in AI investments is expected to persist. On the other hand, the integration of AI and generative AI technology into business operations is expected to emerge as a growth driver. A survey conducted by Ernst and Young revealed that seven out of ten private equity managers recognize the imperative of adopting AI to stay competitive. The application of AI may expand from traditional functions such as due diligence, LP requests, and reporting to expediting key business levers like cost reduction, top-line transformation, and revenue growth. For instance, Blackrock utilized generative AI to develop an efficient co-pilot tool for its risk management systems, Aladdin and eFront.

Figure 3: Investment Opportunities Moving Up the AI Technology Stack

Source: Blackrock

Capital Will be Channeled Toward Climate Infrastructure

The bipartisan Infrastructure Investment and Jobs Act, along with the Inflation Reduction Act, has presented private equity firms with substantial incentives to focus on investing in infrastructure, particularly in climate infrastructure. Despite an overall 12% decrease in private equity fundraising in 2022, fundraising for climate funds nearly tripled, per BCG. This upward trajectory is anticipated to gain further momentum in 2024, given that North America will need an additional $6 trillion in capital by 2030 to stay on course to achieve net-zero emissions by 2050. The confluence of regulatory tailwinds and the surging demand for climate technology, driven by an increasing number of businesses adopting net-zero goals, positions investments in climate infrastructure at the forefront of industry trends.

Read more: The Dragon's Dilemma: China's Path in a Shifting Global Landscape

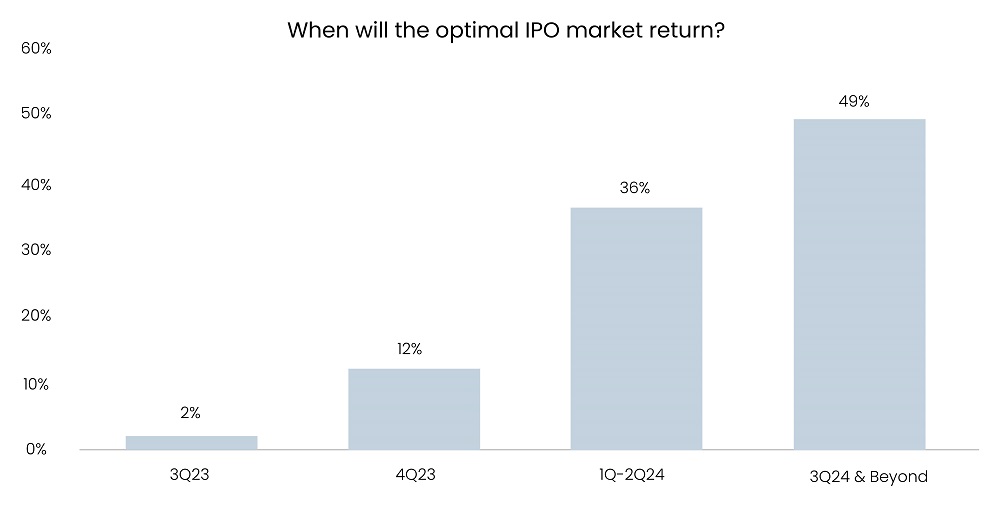

Exit Markets to Return to Normalcy

In 2023, liquidity via traditional routes faced challenges, slowing the cadence of the industry’s natural fundraising cycle. The initial public offering (IPO) market was notably silent for the majority of 2022 and 2023. While Cava, a Mediterranean restaurant chain, debuted on the New York Stock Exchange in the month of June, its shares currently trade approximately 30% lower than their peak in late July. Similarly, Arms and Instacart, two highly anticipated offerings, also experienced declines of more than one-fifth from their respective highs. Merger and acquisition activity has also been muted, primarily due to the high costs associated with debt financing for buyout executions. The sluggish pace of exits is anticipated to persist into 2024 but is poised for improvement as macroeconomic conditions stabilize. According to a BDO survey involving fund managers and CFOs of portfolio companies, private equity exit activities are expected to return to normalcy by 3Q24. On the one hand, pressure on buyout funds to return capital to Limited Partners before expiration dates is making sellers more willing to entertain lower valuations. Pitchbook highlights that if exits continue at their current pace, 2017 vintage funds are on track to reach maturity, with 20–26% of their invested capital tied up in assets instead of being returned to investors, heightening the urgency to initiate sales. On the other hand, with dry powder levels reaching unprecedented highs, private equity funds are under pressure to deploy capital, making them more inclined to accept higher prices.

Figure 4: Survey Results for Optimal IPO Timeframe in 2024

Source: BDO

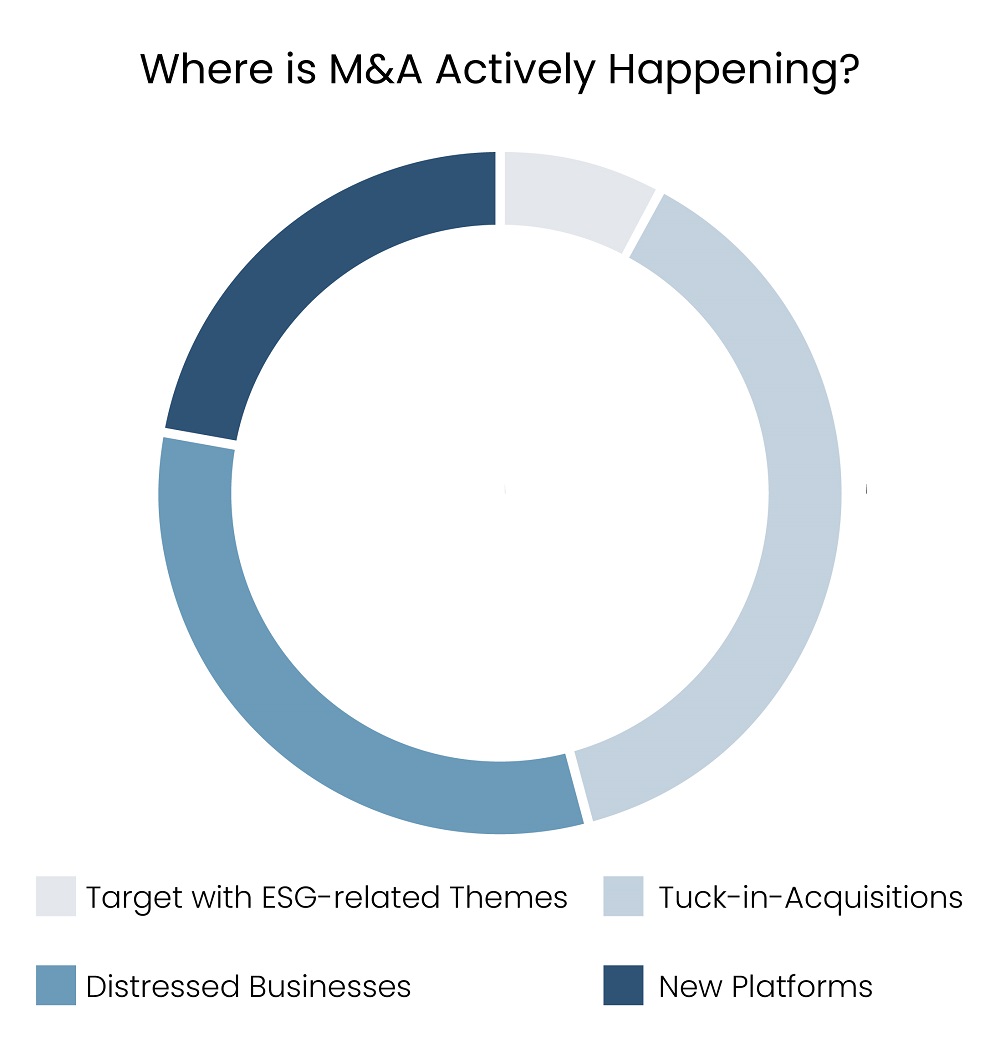

Figure 5: Survey Results for M&A Activity Areas in 2024

Source: BDO

Summary - Private Equity Industry Trends

Although private equity activity in 2023 experienced a significant slowdown, macroeconomic conditions within the US saw robust growth. Looking forward, private equity activity in 2024 is forecasted to witness an adjustment to the current investment climate, which will be marked by muted growth and greater volatility and is expected to continue, at least in the medium term. Private Equity managers are poised to embrace innovative and sustainable strategies, strategically integrating private credit approaches. Substantial investments are forecasted to be directed toward climate infrastructure and AI technologies. Furthermore, exit markets are projected to return to a state of normalcy by the third quarter as macroeconomic pressures gradually subside.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.