Despite the downturn in venture capital (VC) activity last year, one segment that has remained active is the secondary market within the industry. Faced with the challenge of illiquid portfolios in an environment marked by a sluggish IPO market, reduced merger and acquisition (M&A) activity, and declining valuations, VC investors have been exploring alternative options in the secondary market.

The exit activity in 2023 stayed muted, resulting in an industry-wide liquidity crunch. Despite notable IPOs like Klaviyo and Instacart, overall exit values hit a ten-year low. While M&A played a more significant role in exits, increased regulations and scrutiny continue to pose challenges for this avenue.

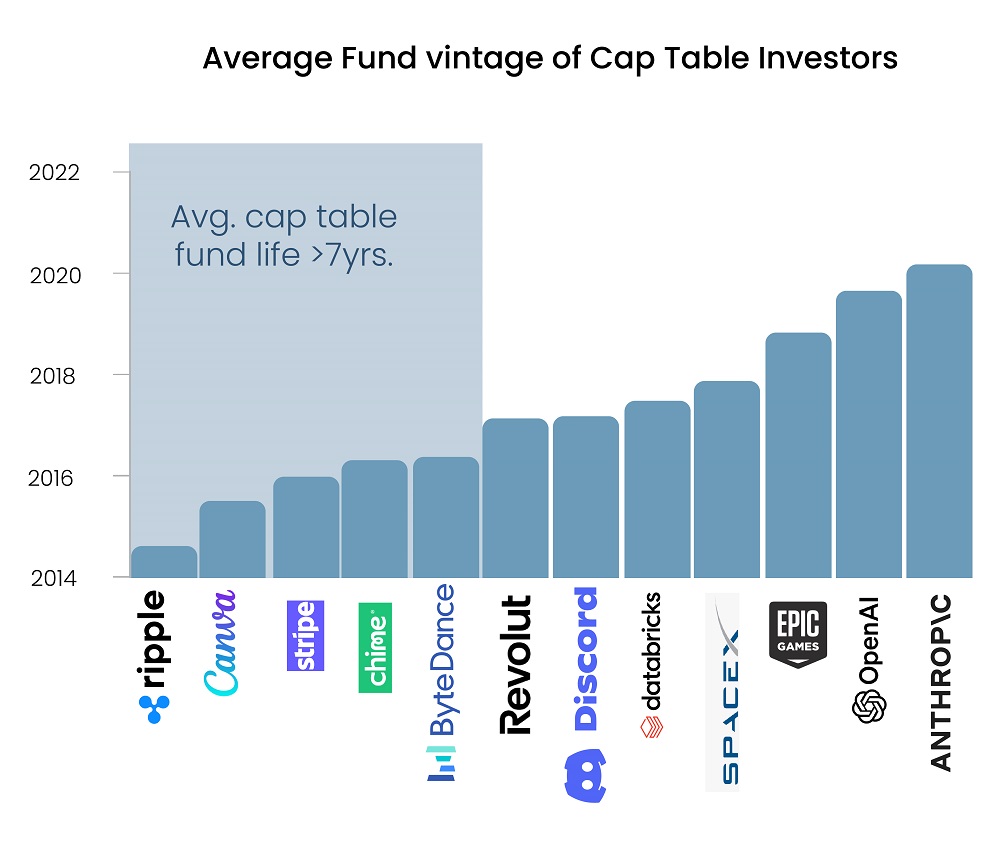

Capital holding periods have experienced a natural extension as a result of the downturn in exit activity. According to Pitchbook, the rate of capital distribution back to investors is currently at its lowest since 2003. Additionally, a substantial number of funds invested in pre-IPO companies are over seven years old, according to Caplight. This has exerted pressure on general partners (GP) to return capital to investors, leading them to explore opportunities in the secondary market. Furthermore, venture secondaries have become a crucial release valve for startup employees who have struggled to realize the value of their stock. In the past year, companies such as OpenAI and SpaceX have facilitated the sale of employee stock through the secondary market.

Read more: Venture Capital Outlook 2024

Figure 1: Average Fund Vintage of Cap Table Investors

Source: Caplight

There is a growing trend among investors to launch new secondary vehicles for acquiring shares in startups at discounted rates. Last year, Forge Global highlighted that the bid-ask spread on secondary market platforms reached approximately 22%, double the optimal level of 11%. Bloomberg reported that startup shares were being traded at significantly lowered prices, with discounts of up to 60% off their original valuations.

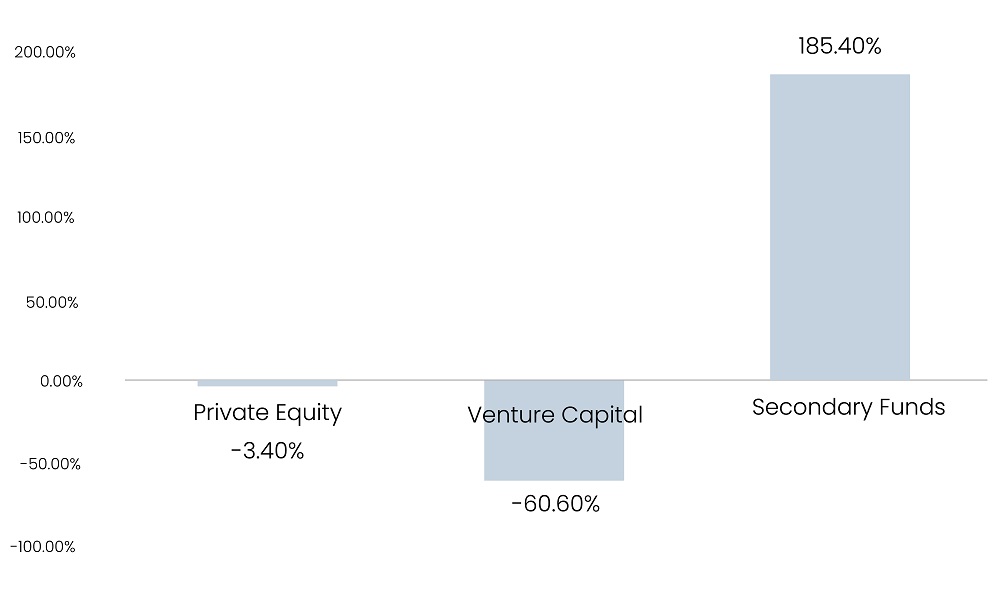

Secondary funds experienced a significant surge in fundraising last year, increasing by almost 185% compared to the previous year, according to Caplight. In contrast, fundraising for both private equity and VC declined during the same period. Industry Venture, a California-based VC firm, recently raised more than $1.45 billion for its latest secondary fund, which will focus on buying minority stakes in later-stage VC-backed companies. Sequoia and Brookfield have partnered with Pinegrove Capital Partners, a Los Angeles-based investment management firm, to each invest $250 million in a $2 billion secondary fund.

Read more: 2024 Macroeconomic Outlook: Unpacking Economic Trends

Figure 2: YoY Change in Fundraising (2023 vs 2022) for US Funds

Source: Caplight

However, the surge in secondary trading activity over the past year has predominantly been driven by a concentration within specific sectors, particularly artificial intelligence (AI), defense, and space, according to Caplight. Much of this activity revolves around companies that have navigated the funding challenges successfully, such as SpaceX and OpenAI, or those positioned as prime candidates for IPOs in 2024, such as Databricks. A key element contributing to this trend is that these companies secured primary funding rounds after the market correction in 2022, making it easier to establish the pricing for a secondary round and narrowing the bid-ask spread. This trend is also reflected in the fact that AI and space startups are trading at less than 10% below their most recent primary valuation, while fintech companies, grappling with difficulties in raising primary funding, are trading at an average of 48% below their last valuation, highlighted by Caplight.

In the secondary market last year, investors were actively seeking to increase their stakes in existing portfolio companies at more favorable valuations, and individual employees were capitalizing on their stock options. Both of these segments are much smaller compared to pre-IPO activity. Anticipated IPOs of Reddit and Shein in the coming period are expected to alleviate exit market pressures, attracting public-market-focused investors to venture secondaries and providing a substantial boost to this segment.

Read more: Top Four Sectors to Watch Out for in 2024

In conclusion, despite a decline in VC activity in 2023, the secondary market, particularly in AI, defense, and space, has remained active. Pressures on GPs to address issues of liquidity, employees leveraging stock options, and investors seeking favorable valuations have propelled venture secondaries. It is, however, anticipated to expand further in the coming year as fundraising resumes to readjust valuations and exit markets ease with expected IPOs.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.