Defense Technology

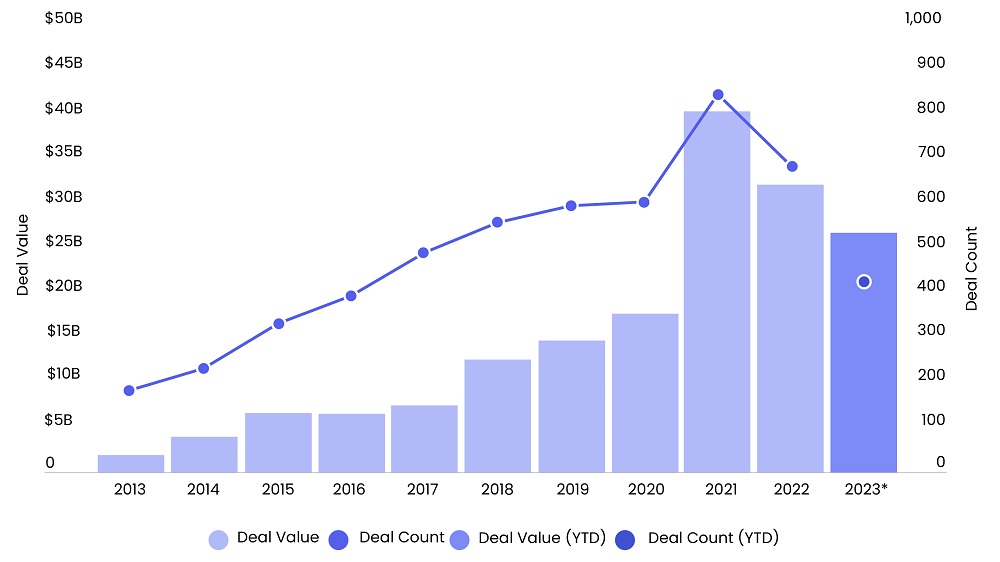

The defense technology sector is poised to experience a significant boom in 2024, making it an area of great interest. Historically, the sector has been marred with moral and ethical dilemmas with lengthy and uncertain processes to obtain government contracts. However, with rising geopolitical tensions and regulatory tailwinds, the landscape for defense technology has changed. The US Department of Defense allocated approximately $1.8 billion for AI applications, up 63.6% from FY23, coupled with $9.3 billion for advanced technologies and $0.69 billion for the experimentation and evaluation of advanced technologies for joint warfare in FY2024. Additionally, companies have started to generate revenue by catering to commercial customers as well, fueling investor interest in startups developing satellite imagery, AI, space tech, cybersecurity, and autonomous robotics. US-based firms in the sector secured nearly $100 billion in venture capital funding from 2021 to November 2023, marking a substantial 40% increase compared to the total investment amassed in the preceding seven years, per PitchBook. Shield AI, a California-based defense tech startup, with its latest Series F-II round of $100 million in December 2023, raised its total funding to $1.07 billion at a post-money valuation of $2.8 billion. Collaboration with Northrop Grumman Corporation, Sentient Vision Systems, and Boeing underscore the confidence of large brands in Shield AI's capabilities. Anduril, a California-based defense tech startup, with its Series E round of $1.48 billion, raised its total funding to $2.32 billion at a post-money valuation of $8.48 billion. The startup recently launched Roadrunner, an innovative product strategically designed to counter the surge of low-cost, high-powered aerial threats, demonstrating its technological prowess. The growth of the industry is also reflected in the significant expansion in the workforce. In 2022, US-based aerospace and defense companies increased their workforce by 101,700 to 2.2 million, marking a 4.87% increase from 2021, per the Aerospace Industry Association.

Figure 1: US VC Deal Activity in Defense Technology

Source: Pitchbook

Generative Artificial Intelligence (Gen AI)

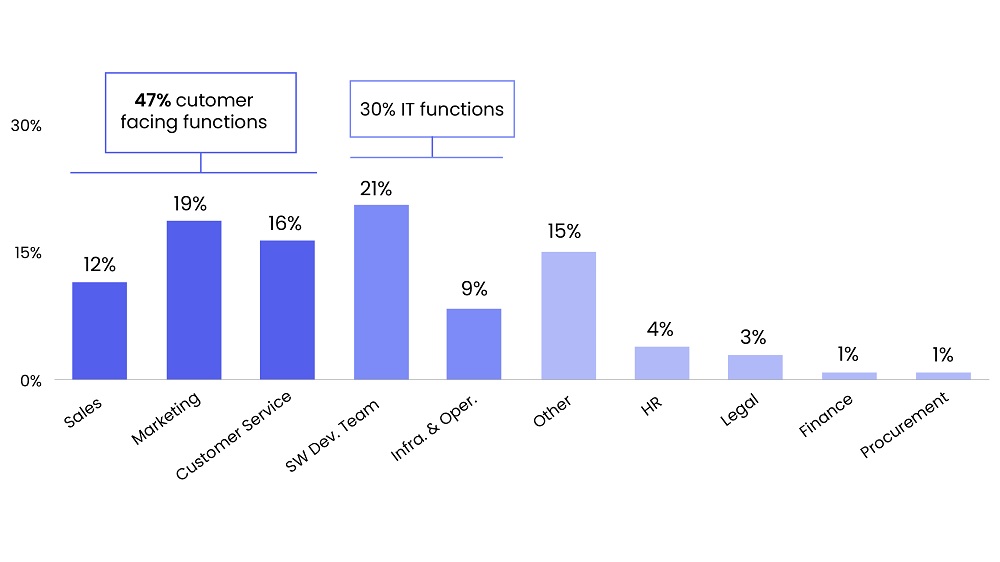

Gen AI has experienced explosive growth in 2023, dominating conversations across industries. The release of OpenAI's ChatGPT interface in November 2022 prompted businesses and organizations around the world to rethink operational strategies to incorporate this cutting-edge technology. Investments in gen AI startups increased from $5.1 billion in the year 2022 to $21.4 billion in 2023, according to Pitchbook. With the heavy influx of nascent projects and rising demand for the technology, the market is poised to explode further and grow to $1.3 trillion over the span of the next 10 years from a market size of $40 billion in 2022, per Bloomberg Intelligence. The gen AI revolution, which was initially focused on textual applications with OpenAI and Anthropic, has recently made advancements to progress in multimedia applications as well, with startups like Midjourney and Runway. Alongside the flurry of development in these third-party applications, a major focus for businesses heading into 2024 will be the incorporation of the technology into their business operations. According to a Gartner survey of 1,400 executive leaders in 3Q23, 55% reported that their organization is piloting or experimenting with generative AI, and another 10% claimed to have already gone live with solutions. The same survey in 1Q23 reported that 70% of organizations were merely investigating generative AI, and only 4% had gone live. Its impact is expected to expand across various industries with the potential to generate significant value across use cases. E-commerce and retail, finance, marketing and advertisement, legal services, and education, among other segments, are all expanding their service by adopting generative AI.

Figure 2: Generative AI Investment by Business Function

Source: Gartner

Read more: Private Investments to Bridge the Climate Funding Gap

Healthcare Technology

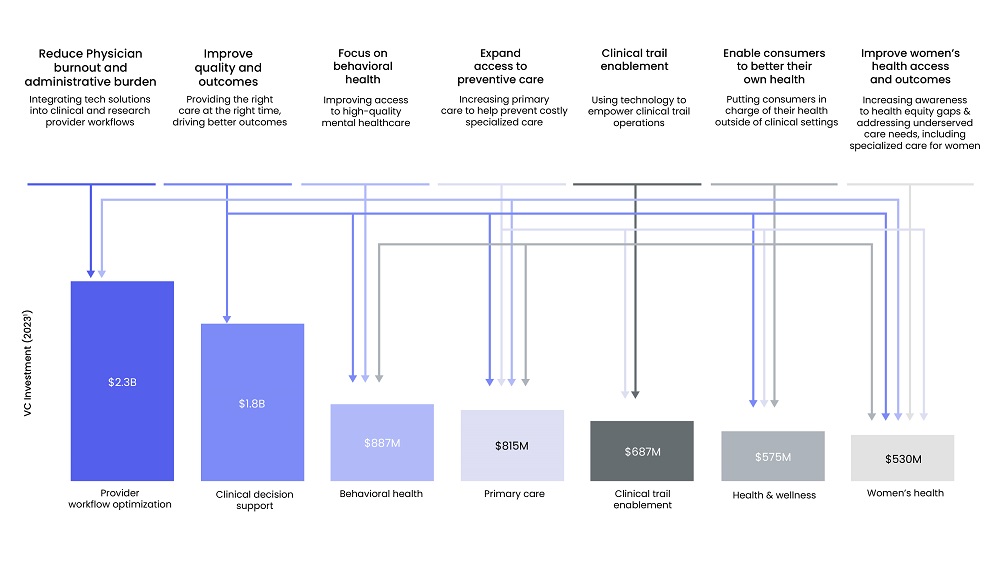

Despite the decline in venture capital investment, the healthcare technology sector is poised for significant growth and innovation in 2024. As the healthcare industry readjusts to the funding surge prompted by the pandemic, a specialized focus on healthcare technology has been in the limelight recently. By the end of 2023, health technology venture funding was projected to be six times greater than funding in 2012, per Bessemer Venture Partners. A leading category for the surge in investor interest has been the integration of AI within operations. According to a survey by Morgan Stanley, 94% of healthcare companies reported to have employed AI or machine learning in some capacity. Additionally, the report projected that the industry's average estimated budget allocation to these technologies would grow from 5.7% in the year 2022 to 10.5% in 2024. The potential of generative AI, which exploded over the past year, is underserved within the industry with adoption in areas like clinical documentation and medical imaging. However, beyond these existing use cases, significant market opportunities are expected to emerge, including ones in care navigation and coordination, reducing administrative tasks, and expanding access to preventative care. Include Health, a California-based care navigation company, with its recent financing in June 2023, has raised a total of $331 million at a post-money valuation of $1.34 billion. Collective Health, another care navigation startup, after its latest Series F round, has raised a total of $759 million at a post-money valuation of $1.53 billion. Beyond the integration of AI, funding interest in surgical robots has stood out, with over $860 million of VC funding raised in 2023, per Pitchbook. The global surgical robotics market is set to grow from $8.5 billion in 2022 to $18.4 billion in the year 2027, at a CAGR of 16.6% between 2022 and 2027, per MarketsandMarkets. In 2023, a few notable fundings in this area include a $150 series F by Distalmotion, a $165 million series E by CMR Surgical, and a $110 million Series C by Cornerstone Robotics.

Figure 3: Key Challenges Healthcare Technology Entrepreneurs are Solving

Source: Silicon Valley Bank

Read more: App Store Monopoly Contested: Value Shifts Towards Application Layer.

Carbon Technology

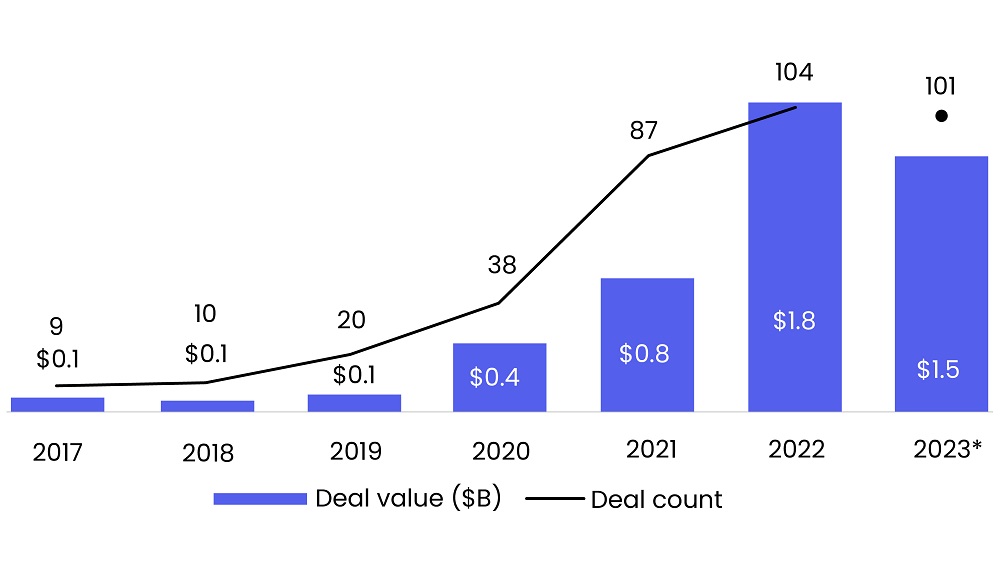

The carbon technology sector is ripe for innovation and investment due to a stark demand-supply gap between the global CO2 emissions of 37.49 billion tons and the available solutions for carbon capture of merely 244 million tons. The pace of emission is quickly outpacing traditional carbon capture methods, making room for technology-driven solutions like direct air capture, carbon capture, and ocean-based capture. Additionally, significant regulatory tailwinds, including initiatives like the Infrastructure Investment and Jobs Act as well as the Inflation Reduction Act, provide the framework and financial incentives for carbon tech ventures to become more commercially viable. Further, 66% of Fortune 500 companies committed to near or long-term net zero targets by 2023, marking a significant impact in corporate pledges for carbon neutrality. The voluntary carbon credits market is estimated to expand from $2 billion in 2021 to $10-40 billion by 2030, per Shell and BCG. The compliance carbon credit market has soared to approximately $850 billion in 2021, reflecting a 2.5-fold increase from 2020, per Shell and BCG. The global renewable energy certificate market is projected to reach $103.2 billion by 2030, at a CAGR of 27.2% between 2021 and 2030, per Allied Market Research. Venture capital investment in carbon and emissions tech hit a record $7.6 billion in 3Q23, per Pitchbook, reflecting investor confidence in the sector. Emerging startups focusing on software solutions for accounting and management environmental commodities stand to capitalize on the accelerated growth within the overarching market. Notably, Persefoni, a SaaS startup based in Arizona that offers a robust climate management and accounting platform, is poised for substantial future valuation. Likewise, Watershed, a California-based startup specializing in climate platforms, is well-positioned to leverage the increasing adoption of technology-driven carbon removal. Moreover, Xpansiv, a California-based international marketplace for ESG commodities, is strategically positioned for robust growth.

Read more: 2024 Macroeconomic Outlook: Unpacking Economic Trends

Figure 4: Carbon and Emissions Tech VC Deal Activity

Source: Pitchbook

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.