As we navigate 2024, the healthcare industry stands at a pivotal point, facing critical financial and operational challenges. In 2022, over half of the hospitals in the US reported negative margins, per data from the Healthcare Financial Management Association. Although there was a slight improvement in 2023, the ratio of hospital downgrades to upgrades remained 3:1, per Fitch Ratings. Looking ahead to 2024, the outlook for providers depends on their ability to strategically manage revenue generation and cost reduction. Fitch categorizes this year as a crucial "make or break" period for a substantial portion of the healthcare sector.

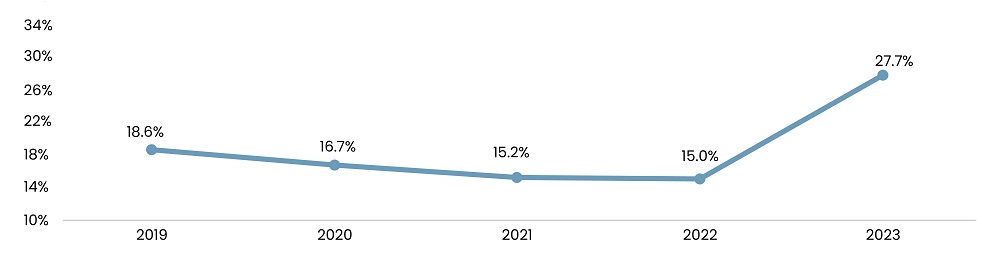

Surge in M&A Activity

As economic pressures persist, healthcare providers will increasingly consider consolidation, recognizing the operational advantages of unified management. In 2023, financial challenges played a significant role in driving M&A activities, with financial distress cited as a factor in 28% of announced transactions, a notable increase from 15% in 2022, per Kaufman Hall. Despite regulatory changes implementing stricter standards for assessing whether proposed deals could result in excessive market concentration, M&A activity is anticipated to rise steadily. A recent report from KPMG predicts a surge in megadeals and cross-market transactions, allowing for new economies of scale without triggering antitrust concerns. The industry headwinds have restrained investor interests, making strategic acquisitions the predominant choice. According to Pitchbook, firms that have traditionally focused on healthcare providers are now pivoting toward healthcare IT and pharma services. The Health Assurance Transformation Corporation, a subsidiary of the venture capital firm General Catalyst, recently announced its intention to acquire Summa Health, a hospital system in Ohio. Penn Medicine plans to acquire Doylestown Health. In New Jersey, Hudson Regional Hospital and CarePoint Health System have declared a merger, forming a new system encompassing both for-profit and nonprofit hospitals.

Read more: Key Takeaways from Consumer Electronics Show (CES) 2024

Figure 1: Percentage of Announced Transactions Involving a Financially Distressed Party, 2019 – 2023

Source: Kaufman Hall

Increased Investment in Outpatient Services to Reduce Costs

This year, health providers are poised to boost investments in outpatient services, aiming to expand their geographic presence at relatively low costs while catering to evolving patient preferences. Establishing facilities in convenient locations capable of embracing emerging technological trends holds the potential to attract recurring patients and is often less capital-intensive than traditionally large infrastructural setups. According to Kaufman Hall, revenue from outpatient services has witnessed significant growth, increasing by more than 40% compared to 2020. This surge is attributed to the growing preference for outpatient care influenced by changes in patient choices, enhanced feasibility of delivering care in such settings, and increased digitization. Additionally, the Centers for Medicare and Medicaid Services project a substantial 16.9% growth in the demand for outpatient services among individuals aged 55 and above by 2025, offering a transformative opportunity for the healthcare industry.

Read more: Shifting Strategies: Venture Capital’s Shift to Secondary Markets

The shift to adopt increased outpatient services, driven primarily by cost reduction efforts, is anticipated to be coupled with the divestiture of more costly lines of service. Hospitals are likely to experience closures in departments such as maternity services, inpatient rehabilitation services, or behavioral units, particularly in rural facilities. Becker’s Hospital Review noted that over 70 hospitals undertook department closures or service terminations in 2023. ACEP Now reported that 640 hospitals, predominantly in rural areas, recently did not pass financial stress tests, indicating they are at immediate risk of closure, prompting a reduction in expensive yet essential services.

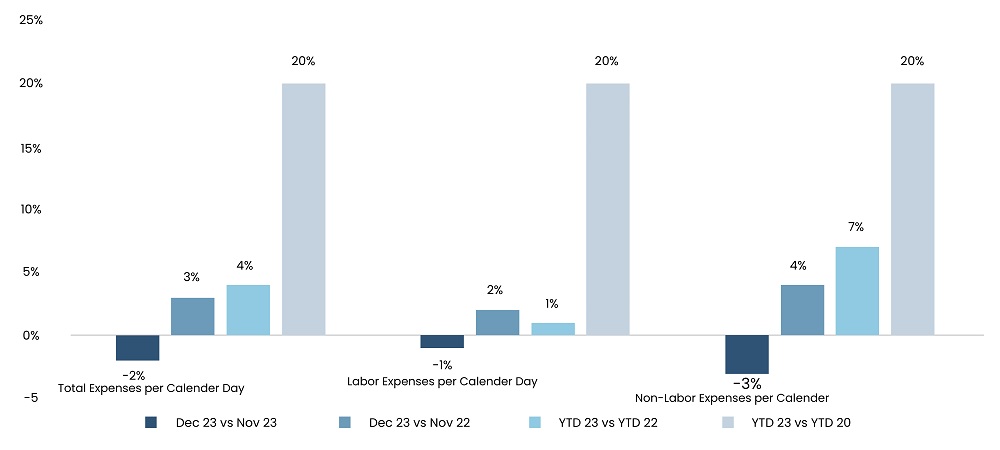

Increased Outsourcing to Tackle Labor Shortage

Given the current and anticipated shortages in staffing, coupled with the consequent increase in labor rates, the success of providers in attracting and retaining permanent staff is crucial for alleviating pressure on margins. Despite a slower growth rate of 4.7% in average hourly earnings in 2023 compared to the peak during the pandemic, this still surpasses the 2.4% average increase from 2010 to 2019, as reported by Fitch. Healthcare Dive noted that HCA Healthcare achieved a 20% year-over-year reduction in contract labor costs, Tenet Healthcare lowered contract labor costs to 4.3% of salaries, wages, and benefits, and CHS Healthcare was aiming for a 50% reduction in contract labor spending compared to 2022.

An increasingly available option for providers is the outsourcing of certain operations. Although health systems have not historically engaged in outsourcing business processes to the same extent as other industries, there is a potential shift in this trend. A Deloitte study observed a growing interest among large health systems in offshoring some back-office functions. The study projects that large health systems spending $50 million on finance and accounting functions could cut those costs in half by offshoring. Outsourcing specific administrative functions could free up funds for increased investment in labor resources.

Read more: Top Four Sectors to Watch Out for in 2024

Figure 2: Percentage Changes in Hospital Expenses

Source: Kaufman Hall

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.