Despite spending millions on lobbyists and a transparency push, TikTok has been under increasing scrutiny in the US as concerns mount over the popular social media app's handling of user data and its ties to the Chinese government. Bipartisan momentum is building up for Congress for a crackdown on TikTok, with some lawmakers even proposing an outright ban on the app. And even if TikTok is not banned from the US, the major play stores –Apple and Google – are under increasing pressure to ban the app from App Store and Play Store, respectively.

For its part, TikTok has stepped up transparency efforts over the years to ease privacy concerns and evade a total ban. In 2020, the company launched its industry-leading Transparency and Accountability Centers to allow experts to access its moderation practices and information about its recommendation system. Additionally, the company also started routing the data of US users to US-based servers owned by Oracle as part of its transparency push. In the latest development, TikTok said it will share public data on content and accounts on its platform with more academic researchers.

Read more: Digital Marketing Outlook: Top Trends for 2023

TikTok’s Meteoric Rise in the US

Despite privacy concerns and China links, TikTok has seen tremendous growth in the US. Factors such as its unique and simplified user interface, algorithm-based content discovery system, and its highly engaging and entertaining content have led to massive popularity among the younger population, particularly Gen-Zs. Additionally, TikTok's emphasis on short-form video content fits well with the modern trend of quick and easily digestible media.

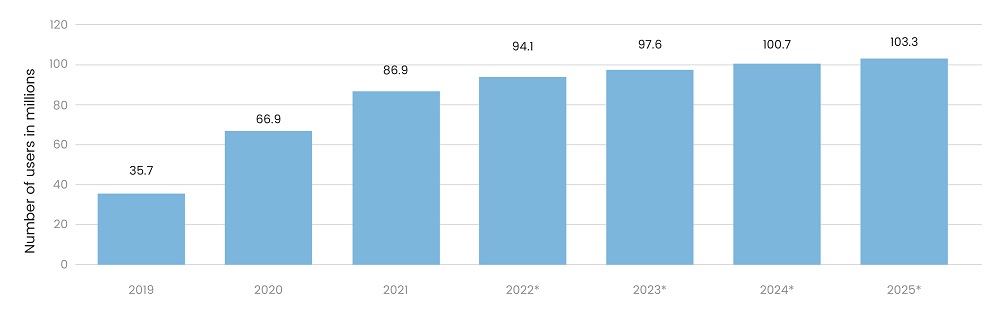

Statista estimates that TikTok had 90+ million users in the US, with the number expected to reach 103 million by 2025. In addition to viral dance trends, comedic skits, and creative challenges, Gen-Zs are also using TikTok to research a major news event, per data from Morning Consult. This has also prompted major news publishers to sign up on TikTok, with prominent outlets such as The New York Times and The Wall Street Journal opening TikTok accounts in the last six months.

Fig 1: TikTok’s Growing Popularity in the US

Source: Statista

Another important factor in TikTok's popularity is the app's community-based approach to content creation. Unlike other social media platforms, which often emphasize individual creators and influencers, TikTok encourages collaboration and sharing of content. This has created a sense of community among users, who often collaborate and build off each other's ideas.

Read more: Leveraging Data Analytics in Business and Finance to Drive Growth

A History of Regulatory Interventions by the US Government

As of February 2023, at least 30 states have announced or enacted bans on state government agencies, employees, and contractors using TikTok on government-issued devices. But the attempts for increased censorship of TikTok started during the era of former President Donald Trump, who viewed the app as a national security threat.

- November 2019: The US Committee on Foreign Investment in the United States (CFIUS) opened a national security review into ByteDance's acquisition of Musical.ly, which later became TikTok. CFIUS was concerned that the acquisition could give the Chinese government access to US user data.

- August 2020: President Donald Trump issued an executive order that would ban TikTok in the US if it did not sell its US operations to a US company within 45 days. Trump cited national security concerns, arguing that TikTok could be used by the Chinese government to spy on Americans.

- September 2020: The US Department of Commerce announced a ban on new downloads of TikTok and WeChat (another Chinese-owned app) in the US, citing national security concerns. The ban was scheduled to take effect on September 20 but was later blocked by a federal judge.

- November 2020: A federal judge granted a preliminary injunction that prevents the US Department of Commerce from enforcing the TikTok ban. The judge argues that the government had likely overstepped its authority in trying to ban the app.

- December 2020: The US Congress passes the National Defense Authorization Act, which includes a provision that requires the Department of Defense to create a list of "covered" software applications, which would include TikTok. The provision is aimed at preventing government employees from using apps that could pose a national security risk.

- June 2021: President Joe Biden revokes Trump's executive order that would have banned TikTok in the US. However, the Biden administration continues to review potential national security risks posed by the app.

- August 2021: The US Federal Trade Commission (FTC) settles with TikTok over allegations that the company had illegally collected personal information from children under the age of 13. TikTok agreed to pay $92 million in fines and to implement new privacy protections for children.

- June 2022: Federal Communications Commissioner Brendan Carr expressed concerns that personal data from millions of U.S. TikTok users is being accessed in China, calling on Apple and Google to remove TikTok from their app stores.

- December 2022: Congress passed a large bipartisan spending bill that has a provision to ban TikTok from being used on government devices.

Read more: Outlook 2023: Top Strategic Technology Challenges

TikTok’s Lobbying Efforts

TikTok has engaged in extensive lobbying efforts in the US to address concerns about its ties to China and potential national security risks. In 2020, TikTok and its parent company ByteDance spent nearly $2.61 million on lobbying efforts in the US, up from just $270,000 in 2019. Publicly available data reveals that since then, the company has doubled down on its lobbying efforts, having spent $5.18 million in 2021 and nearly $5.5 million in 2022.

TikTok has also sought to increase transparency around its data practices and to distance itself from the Chinese government. The company has established a US-based content moderation team and has taken steps to store US user data in the US. TikTok's lobbying efforts have helped to shape the conversation around the app in the US, but the company continues to face scrutiny from lawmakers and regulators over its ties to China and potential security risks.

Alternatives to TikTok

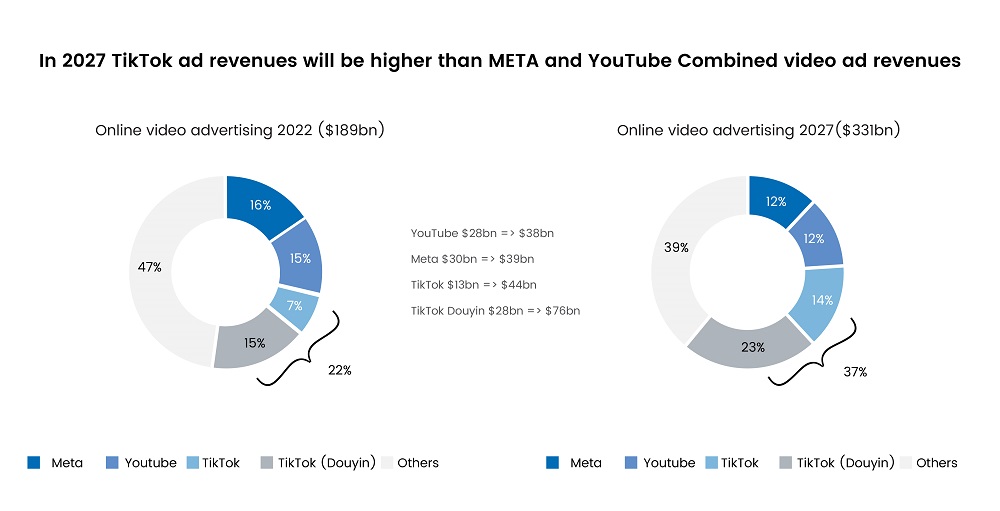

While an outright ban on TikTok will be a major blow to the Chinese tech industry, it could prove to be a great opportunity for other short-form video platforms in the US. An obvious beneficiary would be Instagram Reels. Additionally, YouTube Shorts will be able to attract a significant user base looking to migrate from TikTok. TikTok has remained the biggest competitor to both platforms, with projections from Omdia suggesting that TikTok’s ad revenue is likely to reach $44 billion by 2027 from $13 billion in 2022.

Fig 2: TikTok Ad Revenue Likely to Surpass That of Meta and YouTube by 2027

Source: Omdia

Read more: A Way Forward: Cybersecurity Trends to Watch out for in 2023

Furthermore, there are a few VC-backed start-ups that are perfectly poised to fill the gap. Triller, a California-based short-form video start-up, is a strong alternative. The company has raised $553 million in funding, having secured a Series D round in September 2022. The open-source content platform, which was expected to go public in 2022, has 350+ million downloads and has undergone a strong growth trajectory. California-based influencer marketing platform CreatorIQ allows brand marketers and advertisers to optimize and own their influencer marketing campaigns. The company has raised $79 million over four funding rounds, with a Series C extension round of $40 million in September 2014 that valued it at nearly $175 million.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.