Trump’s planned tariffs seek to strengthen domestic manufacturing, increase federal revenue, and safeguard the US dollar's dominance. However, they risk raising household costs, straining relations with key trade partners, and triggering shifts in global trade dynamics.

During his campaign, President-Elect Donald Trump proposed to raise tariffs to 60% for all goods imported from China and 20% for those brought in from the rest of the world. Mexico and Canada, the US’s top trading partners, will be facing a 5% additional tariff due to their failure to reduce irregular border crossings and drug trafficking. He also pledged to impose an additional 10% tariff on China due to the influx of Chinese drugs in the US.

Trump is widely recognized for imposing tariffs on imports from various countries as part of his America First policy. Tariffs provide a significant revenue source for the federal government, helping offset the decline in domestic tax revenues caused by tax cuts, as seen during his first term, wherein tariff revenues doubled to $74 billion between 2015 and 2020. The Tax Foundation estimates that a universal 10% tax will produce $2 trillion in federal government income between 2025 and 2023, while a 20% tariff will raise revenue by $3.3 trillion.

Tariffs aim to boost domestic manufacturing by making imports more expensive. This incentivizes businesses to shift supply chains and production facilities back to the US, potentially creating jobs and revitalizing the manufacturing sector. Additionally, tariffs seek to reduce the US trade deficit by discouraging imports and strengthening the US dollar.

Read more: Is Trump Bad News for Climate?

The Impact of Tariffs

Despite these goals, many experts argue that the long-term effects of tariffs will be more harmful than beneficial. These tariffs will reduce GDP by 0.4 percent and employment by 344,900 jobs in the long run, as per estimates by the Tax Foundation. Although it is claimed that foreign countries pay the tariffs, the reality is that US companies importing goods bear the cost, which is then passed on to American consumers, contributing to inflationary pressure. The Peterson Institute for International Economics estimates that the proposed tariffs will cost the typical US household more than $2,600 annually.

In 2023, Mexico and Canada contributed approximately 16% and 14% to total U.S. imports, respectively, as per the UN COMTRADE international trade database. The additional tariffs will likely increase grocery and gasoline prices. Both Canada and Mexico supply cement, metals, and machinery-related products to the US, which can raise construction costs. The Tax Foundation estimates that taxes on US households will rise by $1,253 on average in 2025 under a 10% universal tariff and an average of $2,045 under a 20% universal tariff.

The World Reacts

Trump's promise to impose tariffs on trade partners drew significant global reactions. China's response emphasized the mutual benefits of Sino-American trade and warned against the perils of a trade war. "No one will win a trade war,” stated Liu Pengyu, Chinese embassy spokesperson. Similarly, Mexican President Claudia Sheinbaum criticized the approach, highlighting that threats and tariffs would fail to address deeper issues like migration and drug consumption, warning of potential harm to both economies.

Read more: China Closing AI-Innovation Gap with the US

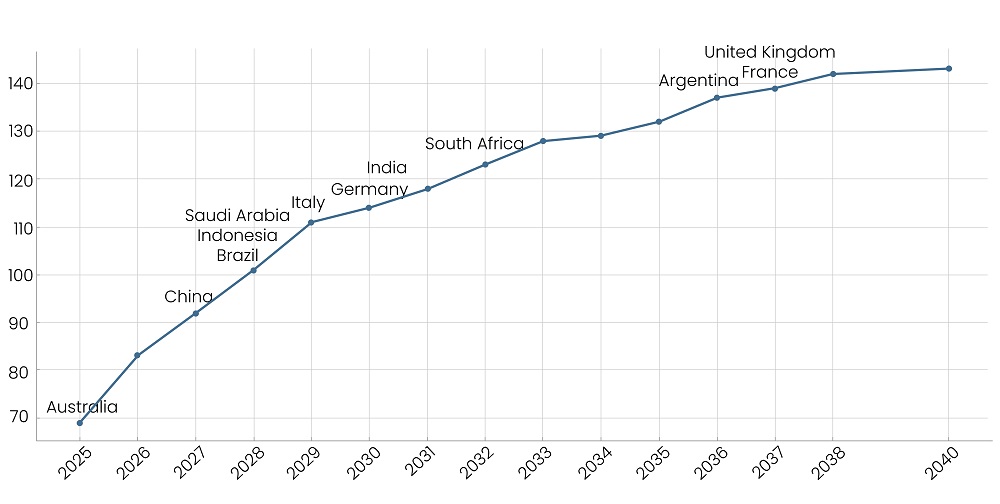

Figure: Identifying new buyers: Trading partners fully replace lost exports to the US by year

Source: Global Trade Alert

Canadian officials expressed concerns about border security and energy supply implications, emphasizing a cooperative approach in discussions with the incoming administration. Prime Minister Justin Trudeau's call with Trump sought to address the challenges constructively. Economist Simon Evenett projected in the Global Trade Alert Report that even with a US market shutdown, many nations, including Australia, Brazil, and India, would recover export losses through alternative markets by 2030, underscoring global resilience in the face of such policies.

Threat to BRICS nations

Trump threatened to impose a 100% tariff on nine BRICS nations if they attempted to create a currency that is set to replace the US dollar as the world's reserve currency. Such tariffs, if imposed, will change the world trading dynamics. The threat comes from the fear that a newly formed currency would be detrimental to the dominance of the US dollar across global trade, which grants the US significant geopolitical influence and lowers federal borrowing costs.

Brad Setser of the Council on Foreign Relations presented that the tariff threat inadvertently strengthens BRICS’ stature while reflecting poorly on US confidence in the dollar’s dominance. Such actions will likely project unnecessary concern over a nonviable threat. Moreover, the proposed tariffs would likely harm US consumers by increasing the cost of imports from BRICS nations, including staples like Brazilian coffee, Chinese electronics, and South African minerals, potentially exacerbating inflation. While the possibility of implementing such tariffs is slim, the threat has heightened tensions, casting uncertainty over future US-BRICS trade relations.

Read more: Reasoning Redefines AI as Scaling Hits Plateau

Conclusion

Trump’s proposed tariffs aim to improve manufacturing and federal revenue, but they risk raising consumer expenses, hurting international relations, and boosting inflation. The future will hinge on the US's ability to balance protectionist policies with global cooperation, shaping a trade environment that could either reinforce its economic leadership or accelerate a shift toward a more multipolar global economy.

Partner of choice for lower middle market-focused investment banks and private equity firms, SG Analytics provides offshore analysts with support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.

About SG Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.