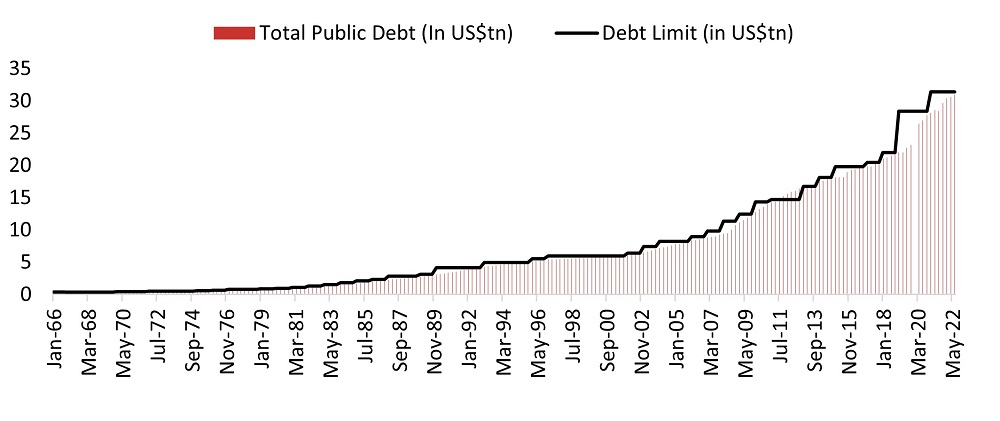

The U.S. government is likely to exceed its borrowing limit in just a few days as the treasury secretary, Janet Yellen, informed Congress in early January that the country hit its $31.4 trillion debt ceiling. Consequently, the treasury would need to pursue “extraordinary measures” to ensure it does not default on payments. While this event risks resurface frequently, the political and economic implications vary based on the time taken by the Democrats and Republicans to resolve the matter. As the government approaches the deadline to raise its debt limit, the possible risk of default increases, which could have an adverse impact on the markets and economy.

What is a Debt Ceiling?

A debt ceiling is a limit imposed by Congress on the U.S. Federal government’s outstanding debt. This means Congress has already instructed President Biden’s government to spend the money but has limited access to all the money he needs to carry out the spending.

What Happens When the U.S. hits the Ceiling?

Currently, the U.S. Treasury has less than $400 billion cash on hand, and the U.S. government is expected to borrow around $100 billion per month in 2023. When the debt reached near its limit, which Janet Yellen indicated that it occurred on 19th January 2023, they started conserving cash and stopped making payments for some services to buy time for negotiations. For example, the government temporarily suspends retirement programs for government employees with expectations that when the ceiling is raised, the government will make up for the difference.

Read more: How Fintech Companies are Revolutionizing B2B Payments

Currently, the department has taken some “extraordinary measures” to keep the government operating. The Treasury Department announced on 30th January that it plans to increase its borrowing during the first three months of 2023 (1Q23), despite the debt going to cross a $31.4 trillion limit. The U.S. also plans to borrow $932 billion during 1Q23, i.e. $353 billion higher than projected in October 2022, amid a lower cash balance and estimation of lower-than-expected income tax receipts as well as higher expenditure. Janet Yellen said that her actions would buy some time until Congress can pass legislation that will either raise the nation’s borrowing authority or suspend the limit for a period of time. Further, Janet mentioned that cash and extraordinary measures are unlikely to be exhausted before early June.

However, as they run out of these measures (market participants expect it to happen by mid-summer) and the lawmakers fail to agree on increasing the limit, the government is likely to face a default risk. The department also needs to decide who should get paid with the daily tax revenues they receive due to restrictions on the borrowings. This may lead to government employees not being paid in full, veterans losing their vital health and living benefits as well as seize on loans to college students and small businesses.

The default can have devastating financial and economic implications, including a total freeze on additional borrowings, soaring interest rates, panic in financial markets and economic recession. Historically, when markets start panicking, the president and Congress come into action. In 2013, the government was shut down for 16 days after Republicans sought to defund the Affordable Care Act (ACA) by leveraging the debt ceiling. However, the current situation does not look normal as major political parties are more polarized than ever. Additionally, the concessions McCarthy gave to Republicans may make it impossible to crack a deal on the debt ceiling.

Read more: 7 Trends That BFSI Industry Cannot Ignore Anymore- Get Ready for 2023

When will the Government Run out of Cash?

While it is hard to figure out the timing when the government will hit its debt ceiling as payments and receipts vary daily, given the filing deadline for income taxes is April 2023. However, the current balance indicates the debt ceiling could be reached as early as March-end.

What is a Political Standoff?

Currently, the Democrats hold the majority in the Senate and the Republicans in the house of representatives, so the debt ceiling has become a negotiation issue. The Democrats want to increase the limit without any conditions, whereas the Republicans want the government to cut down on spending. Any negative outcome during the period of negotiations could fuel volatility and uncertainty in the market. Even if there is a short-lived standoff, it could lead to irreversible harm to the U.S. economy by eroding household and business confidence and global financial stability. Uncertainty also threatens the low-interest rate enjoyed by the U.S. government on its borrowing, which is considered a relatively safer bet with high liquidity. Risky situations like the political standoff could raise the interest rates, and even a 25bps increase could translate into the additional burden of ~$60bn a year, pressurizing government coffers.

That said, raising the ceiling has become quite a common procedure for Congress; since 1966, it has increased 40 times.

Read more: Leveraging Data Analytics in Business and Finance to Drive Growth

What does History Suggest?

Nevertheless, in the past, there have been instances of political standoffs on the issue:

-

2011: President Barack Obama

The standoff in 2011 between the Democrats and the Republicans was the most controversial and led to a first downgrade in the U.S. ratings by S&P Global Ratings. However, the ceiling was raised just two days before the expected date of default. According to the Government Accountability Office, U.S. borrowing costs increased by $1.3 billion that year.

-

2013: President Barack Obama

Again, the debate over raising the limit led to the government shutdown. According to Fed Economists’ study, when the debt limit was about to breach, the yields of treasury securities scheduled to mature near the projected date rose between 4bps-8bps. However, such small effects point toward the market expectation that the debt ceiling will be raised and the standoff will be short-lived.

-

2021: President Joe Biden

The Biden government experienced a political standoff in 2021 but prevented the first-ever U.S. default by raising the limit by $2.5 trillion. During this time, Moody’s ran a simulation that if the standoff lasted several months in the 4Q21, then employment and real GDP would decline by 5 million and about 4%, respectively, in the near term before it recovers over the next few quarters.

What are the Major Market Implications?

As the world economy is going through a rough patch amid a global economic slowdown and elevated inflation levels due to the coronavirus pandemic and Russia’s invasion of Ukraine, a default by the U.S. government could push the country into a deep recession.

-

Increased interest rates on treasury as the credibility of the U.S. government comes under question.

-

Less liquidity for rolling over maturing debt leading to Federal Reserve intervention.

-

Fall in equity indices, a decline in access to the private credit market, and hampered business, household, and market confidence.

-

Delayed payment to social security beneficiaries and many other forms of federal assistance would be at risk, which could have serious economic and health consequences.

-

Default on treasury obligations could further spill over to the financial market and threaten the availability of credit. Also, this could likely undermine the U.S. treasury’s status of being the safest and most liquid market in the global economy.

To sum up, these implications are far-reaching and are likely to impact the already slowed economic activity and can pivot the economy to a deep recession. Subsequently, dampening the tax revenues could lead to a cutback in other expenditure outlays necessary to support the weakening economy.

Read more: Top Venture Capital Trends in 2022

Conclusion

The binding debt limit has become an annual threat event to the economy and markets, as it can have huge implications and could inject volatility in the market depending on the tenor of the standoff. Despite the current standoff, increased borrowing plans for 1Q23 indicate the requirement of debt is dynamic, given the assistance provided by the federal government to the U.S. economy. Hence, a sustainable solution becomes a pressing need to tackle this anticipated disruption. That said, a prolonged period of negotiation could lead to major ramifications on the economy and increase the risk of a rating downgrade.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in Investment Insights, SG Analytics assists in strengthening investment decisions by leveraging custom research support. Contact us today if you are in search of an investment research firm that offers tailored research support across a broad range of asset classes.