The US Labor Department issued an employment report stating the market is expected to show wage gain while maintaining its upward trend. And this anticipated slowdown in job gains is followed by January’s torrid pace in the employment sector.

The U.S. (United States) job growth slowed to a still-solid pace in February. However, the unemployment rate is expected to hold at a more than five-decade low. One of the significant reasons for this could be the Federal Reserve's rise in interest rates to a higher level to tame inflation. This has led the financial markets to expect that the Fed is set to sustain its monetary policy tightening campaign into summer.

Fed Chair Jerome Powell indicated that the U.S. central bank would have to increase rates more than expected. And this could open doors to a 50-basis-point hike this month. While the labor market is still tight and hot, it seems like it is beginning to cool, and the cooling trend is set to continue going forward.

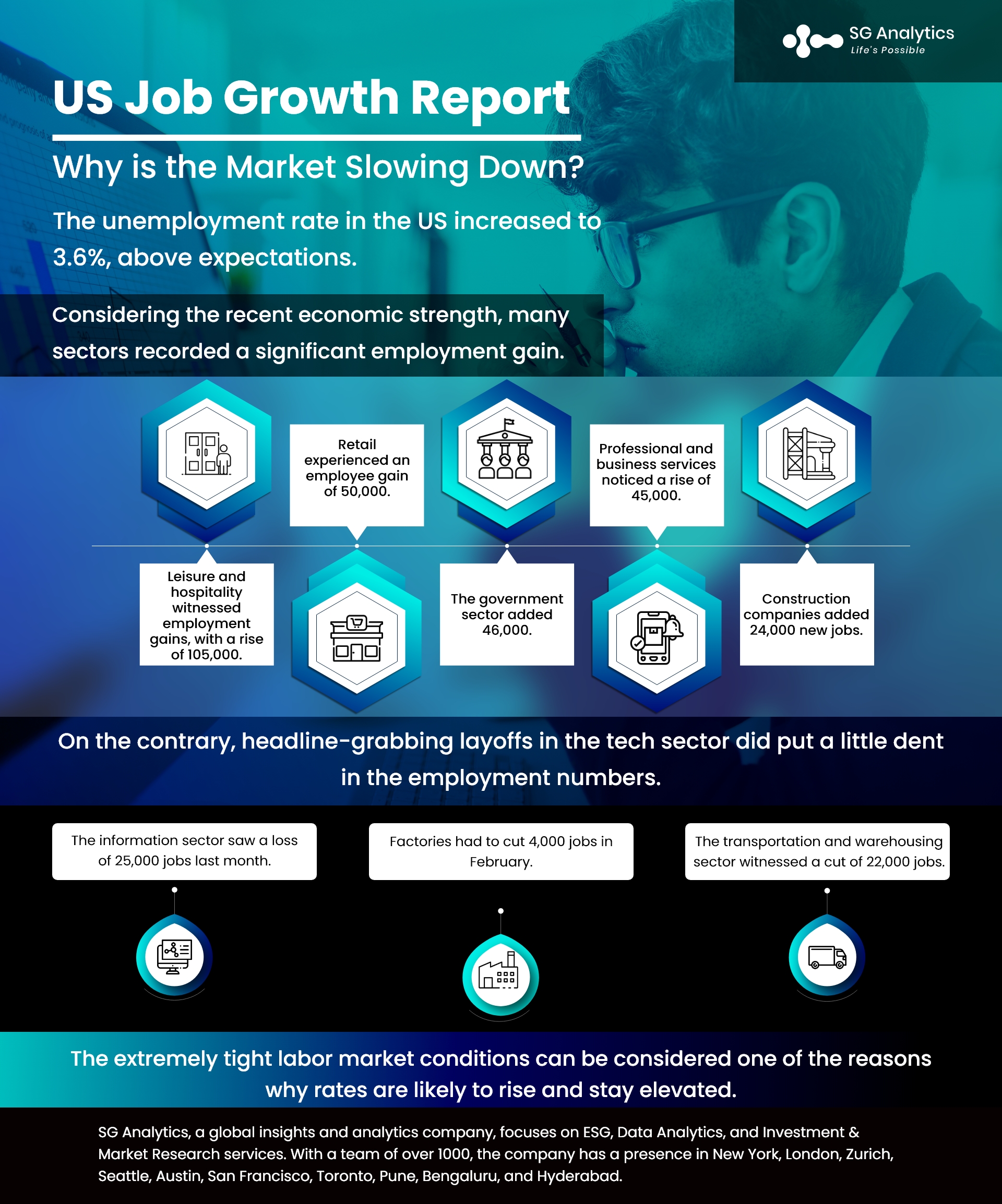

While job creation decelerated in February, there was some good news on the inflation front, as average hourly earnings rose 4.6% from a year ago. And the best news was the easing of wage pressures. Considering the recent economic strength, many sectors recorded a significant employment gain.

-

Leisure and hospitality witnessed employment gains, with a rise of 105,000, about in line with the six-month average of 91,000.

-

Retail experienced an employee gain of 50,000.

-

The government sector added 46,000.

-

Professional and business services noticed a rise of 45,000.

-

Construction companies added 24,000 new jobs, irrespective of the rising mortgage rates that are weighing down the housing market.

On the contrary, headline-grabbing layoffs in the tech sector did put a little dent in the employment numbers.

-

The information sector saw a loss of 25,000 jobs last month.

-

Factories had to cut 4,000 jobs in February.

-

The transportation and warehousing sector also witnessed a cut of 22,000 jobs.

Read more: Investment Trends 2023: Top Tech Stocks to Keep an Eye On

The Existing Labor Market Conditions

The job market growth in January reached a plateau due to many reasons, such as unseasonably warm weather, annual benchmark revisions, and seasonal adjustment factors. The US government used the model to remove seasonal fluctuations from the data. One of the significant factors partially attributed to the seasonal factors was robust consumer spending growth in January.

Financial markets have recorded a 50-basis-point rate hike at the Fed’s March 21-22 policy meeting. The Fed has now increased its policy rate by 450 basis points since March 2022. They can currently be placed in the 4.50%-4.75% range bracket. However, the unemployment rate is unchanged at 3.4%, the lowest since May 1969.

Some economists are cautioning against placing emphasis on the narrow jobless rate gauge. They are of the opinion that the government should instead favor a broader measure of unemployment, including people who want to work but have given up on their job search or those working part-time.

Read more: Digital Banking in 2023: Top Trends to Keep an Eye On

Economists are suggesting examining the three- and six-month averages of payrolls to gain a better understanding of the existing labor market conditions. If February payrolls meet expectations, the three- and six-month averages for job gains can rise above 300,000. This would demonstrate that the anticipated normalization in the labor market is expected to take much longer than expected.

The US government needs to address that inefficiency, but that is currently their main challenge. The Fed needs to be careful about how they interpret the current situation in the labor market. With people unable to move to where the jobs are because of relocation cost barriers, raising rates too high could lead to a surge in unit labor costs as corporations are unwilling to embark on wholesale job cuts, exactly like the one that happened in previous recessions. Source: CNBC

The U.S. Job Market: Hot & Cold Hiring Spree

From the sizzling pace of hiring in January, the situation cooled down in the month of February. However, the U.S. job market is still hot, but the unemployment rate is hovering near a half-century low. Employers added an estimated 311,000 jobs in February, as per the report issued by the Labor Department.

Nonfarm payrolls increased by 311,000 for January, which was above the 225,000 Dow Jones estimate. While this clearly is a sign that the employment market is still hot. But at the same time, the unemployment rate increased to 3.6% from 3.4% in January, as almost 400,000 people joined the workforce.

Read more: Debt Ceiling Standoff - Will the World’s Renowned Economic Safe Haven go into Default?

Estimates for February payroll growth were recorded in a range - from as low as 78,000 to as high as 325,000. And the average hourly earnings were estimated to rise 0.3%, corresponding to the gains in January. This growth is likely to raise the year-on-year increase in wages from 4.4% to 4.7%.

While initially, the Fed was alarmed due to the sudden addition of more than half a million jobs in January, the central bank is now concerned that this overheated job market holds the risk of putting more upward pressure on inflation. The job gains in January were slightly weaker, as 504,000 jobs were added that month.

While the existing conditions in the labor market are very unusual, everyone is eying how the Fed will accomplish the inflation objective without inducing a major economic slowdown.

Key Highlights

-

The unemployment rate in the US increased to 3.6%, above expectations.

-

Nonfarm payrolls increased by 311,000 in February, which was recorded above the 225,000 Dow Jones estimate.

-

Average hourly earnings increased by 4.6% from a year ago. It can be considered a positive sign of inflation.

-

Leisure, hospitality, as well as retail, witnessed new job creation.

Read more: Explained: Factors Driving Tech Layoffs in 2023

Final Thoughts

The job cut report is arriving at a crucial time for the U.S. economy and, consequently, for Fed policymakers. The U-6 unemployment measure in January was at 6.6%. This indicated there were 10.9 million people open to work compared to the 10.8 million openings in the job market at the end of January. But the problem here is the mismatch of factors like locational and skills mismatches, which signifies the labor market is not functioning efficiently.

While inflation data witnessed a downward trajectory toward the end of 2022, the markets expected the Fed to slow the pace of its rate hikes. That happened in February when the Federal Open Market Committee approved a 0.25%-point increase, highlighting the smaller hikes that would be introduced going forward. At the same time, the Fed is closely monitoring the rising wages, which are expected to contribute to higher prices across labor-intensive service industries. The reported wages in February, on average, were recorded as 4.6% higher than a year ago.

While the strong wage growth is being considered a boon for workers, it will only prove fruitful if it is not eroded by inflation. Fed Chairman Jerome Powell addressed that the recent metrics indicate that inflation is back on the rise. And if that continues to be the case, the rates are expected to increase to a higher level than expected.

The extremely tight labor market conditions can be considered one of the reasons why rates are likely to rise and stay elevated. He also implied that the increases could be expected to be higher than the February hike.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Market Research services, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.