In the constantly evolving intersection of finance and technology, one term that precisely resonates with innovation, change, and evolution is AI in fintech.

The emergence of AI in the financial services industry is disrupting the physics of the industry, further weakening the bonds that have held together the components of traditional financial institutions and opening new pathways for more innovations and new operating frameworks.

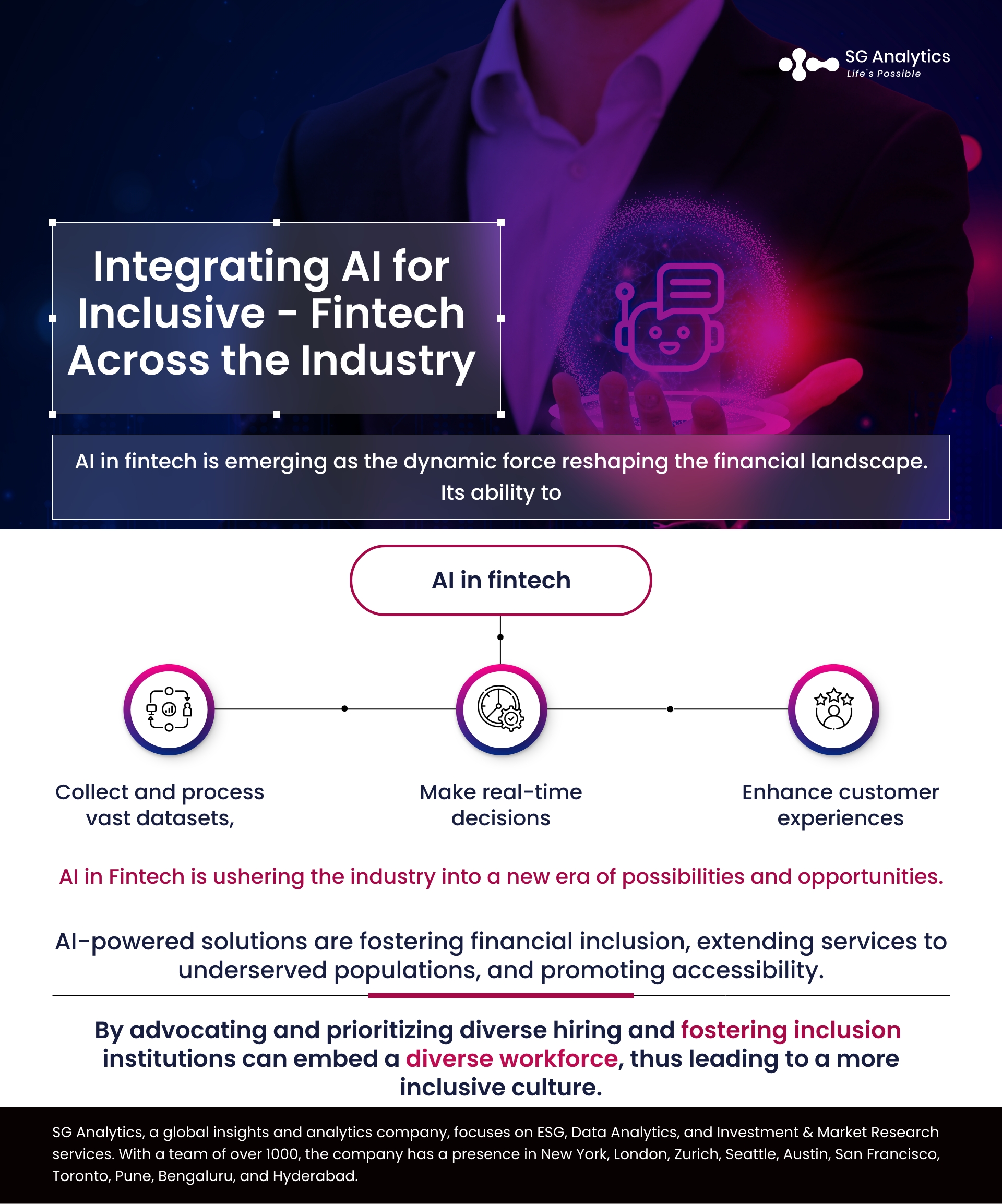

AI in fintech is emerging as the dynamic force reshaping the financial landscape. Its ability to collect and process vast datasets, make real-time decisions, as well as enhance customer experiences. With AI leading the forefront of these advancements, fintech firms are integrating artificial intelligence (AI), ushering the industry into a new era of possibilities and opportunities.

Read more: How is Data Analytics Transforming FinTech?

AI in fintech represents a profound shift in how financial services are conceptualized, developed, and delivered. The impact of AI on the financial industry is revealing the numerous methods of this influential technology and how it is revolutionizing finance. From predictive analytics to chatbots and automation of routine tasks, AI is assisting the industry in streamlining operations, enhancing decision-making, and reshaping the user experience for businesses and consumers.

AI-powered solutions are fostering financial inclusion, extending services to underserved populations, and promoting accessibility. This growing potential for AI in fintech is further bridging gaps, improving financial literacy, and offering customized financial products. With AI continuing to evolve, fintech companies are embracing technology that is poised for innovation and growth. It's critical to harness the power of AI and address associated challenges like data privacy and regulatory compliance. This transformative potential of AI in fintech is undeniable. It is also responsible to unlock new opportunities and elevate financial services. However, the lack of secure access to financial services ends up hindering economic growth, limits opportunities for businesses and exacerbates inequality.

Fintech holds the potential to address this issue by fostering digital financial services that are accessible, affordable, and convenient for all. The growing potential of fintech to boost financial inclusion along with long-term development is further enabling the promotion of inclusivity as well as sustainable economic growth and a productive work environment. It has the potential to help achieve the aim of increasing access to financial services while encouraging entrepreneurship and innovation.

Read more: Building Data Trust: How Leaders are Nurturing and Measuring Stakeholder Trust for Growth

Regulatory Challenges and Risks

Fintech and emerging technologies like big data and artificial intelligence are powerful tools for financial inclusion. However, with technology, there are growing risks involved that regulators must address to ensure consumer protection and trust. Some of the risks fintech regulators face include establishing a trusted environment for digital finance and financial inclusion.

Fintechs are using emerging technology solutions, including big data and artificial intelligence (AI), to address emerging risks. AI can be integrated to mine data from digital financial services and provide regulators with a better understanding of digital transactions, thereby enabling them to make more informed decisions. It can also be employed to support socio-economic development as well as to boost domestic revenue mobilization capabilities. However, the application of AI in digital finance should be carefully implemented, and automated decisions made by the algorithms should be monitored clearly to request explanations and prevent financial exclusion.

Harnessing advanced analytics, predictive models, and data-driven insights is enabling fintech firms to address AI concerns while addressing the impact of inadequate representation across the creation of biased algorithms due to data and diversity issues. Ethics, privacy, potential job losses, and the societal impact of AI are being challenged by the fundamental need for connection and belonging. Due to the growing concerns, there is a need to address the social, ethical, and criminal risks associated with the AI-driven future of fintech.

Read more: Fostering Diversity in Tech: The New Catalyst for Innovation and Growth

AI For Inclusion

The increased use of AI has sparked debates on its potential benefits and possible harm across different industries. Growing concerns have been encompassing machine learning risk, misinformation, and societal risk. When considering AI’s role in inclusion, there have been numerous instances of racist chatbots and biased algorithms.

And recent technological advancements have further intensified the prominence of AI. The global AI market is set to grow at a CAGR of 37.3% between the year 2023 and 2030. And it is time for regulators to take note.

Personal learning within AI will help the workforce stay updated, engage in professional networks, and evaluate the tech stack for continuous learning. As a transformation journey, AI presents users with the tools to achieve the potential and amplify human learning, growth, and efficiency across the fintech landscape. AI can be trusted with diversity, equity, and inclusion. However, fintech firms need to take responsibility to guide and govern it in a way that perfectly aligns with their organizational objectives.

While fintech has long employed automation, machine learning, as well as AI, the industry is now gauging its AI usage, interest levels, and sentiments toward the growing trends.

The initial imposition of the potential of AI in financial services was positive; there has been a growing focus on its substantial influence on fraud detection, revenue forecasting, and credit risk management. There was a tangible buzz about data quality, security, and compliance. AI's potential to revolutionize data processing is also emerging as the next frontier for moving the financial markets.

Read more: US VC Landscape: Navigating Change and IPO Momentum

Fostering an Inclusive Fintech

Fintech is enabling financial inclusion for emerging economies. However, there are certain risks that regulators need to work together to address. This will further help in ensuring that consumers are protected and their data is safe to create trust.

The central challenge between data input and output encompasses decision-making and options assessment. It is clear to understand that AI won't replace the empathy as well as the critical thinking necessary for success. While AI can automate tasks and save time, it still lacks the power to create. The human ability to imagine cannot be replaced by AI. However, discrimination in AI often arises from overlooked datasets and underappreciated perspectives. It can promote inclusivity if directed rightly toward the set goal.

Risks like anti-money laundering, noncompliance, and illicit money flow are some of the risks faced by fintech regulators when working towards establishing a trusted environment for digital finance and financial inclusion. Using AI to detect biases, especially concerning marginalized populations, and fostering ethical and responsible behavior is enabling businesses to establish the growing demand for AI transparency. This is further leading to a growing need for more inclusive practices.

While achieving AI inclusion might require diverse perspectives, fintech institutions are reshaping human-embedded biases by introducing user testing, feedback loops, and multiple iterations to further foster flexible growth. By advocating and prioritizing diverse hiring and fostering inclusion, institutions can embed a diverse workforce, thus leading to a more inclusive culture with bias training, authentic actions, and cultural awareness.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

A market leader in Fintech, SG Analytics assists in navigating financial markets, enhancing portfolios, and making strategic decisions. Contact us today if you are in search of a firm that will help accelerate growth while managing costs, improving customer experience, hyper-personalized offers, and a lot more.

About SG Analytics

SG Analytics is an industry-leading global insights and analytics firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company and has a team of over 1100 employees and has presence across the U.S.A, the U.K., Switzerland, Canada, and India.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.