Implementing monetary policy is akin to planting seeds in a garden. It takes time for the seeds to germinate and grow, just as it takes time for the full effects of monetary policy to be felt in the economy.

There is much evidence that monetary changes have an effect only after a considerable lag and over a long duration and that the lag is rather variable. In order to understand how long it takes the monetary policy to percolate in the economy, we assessed the impact of policy on the economy through the Purchasing Managers Index (PMI) and Leading Economic Index (LEI) indexes in various events in the United States (U.S.). Here, the PMI index represents the prevailing direction of economic trends in manufacturing. LEI, an index published monthly by the Conference Board, is used to predict the direction of global economic movements in future months. The Conference Board is a research organization that publishes several widely tracked economic indicators.

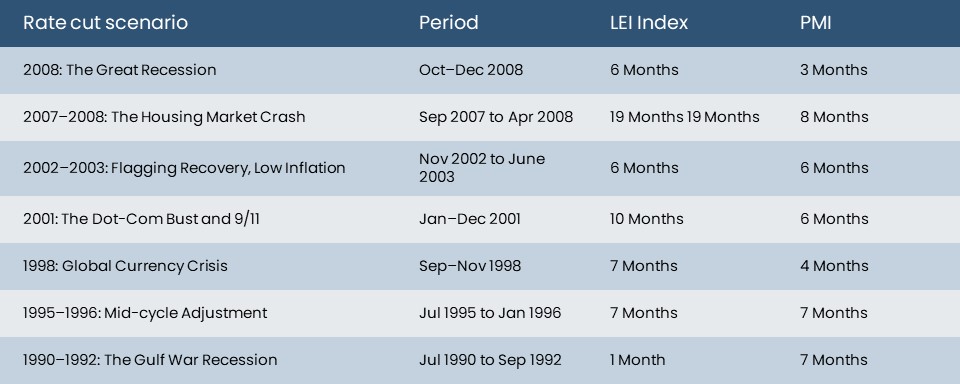

Below is the impact of rate cycles on key economic indicators.

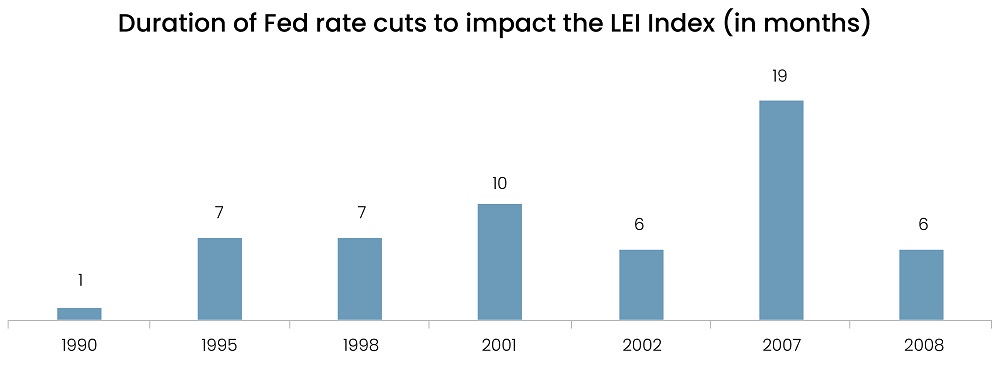

Rate Cuts Scenarios

During the 2007–08 housing market crash, the impact of Fed rate cuts was observed after eight months on the PMI index and after 19 months on the LEI index. The prolonged impact was attributed to the looming recession and the severe economic fallout from the housing market collapse. In contrast, amidst the flagging recovery and low inflation in 2002–03, Fed rate cuts took six months to reflect on the PMI and LEI indexes. Following the Dot-Com bust and the 9/11 incidents in 2001, the impact of Fed rate cuts in that year was more protracted. The PMI improved after six months, while the LEI index saw improvements only after 10 months, reflecting the significant economic and financial market upheaval during that period. In the mid-cycle adjustment of the 1990s, it took seven months for the Fed to stimulate the economy following a 300 basis points (bps) hike within a year.

Read more: Outlook 2024: Fastest Growing Careers in the US

Source: Federal Reserve Economic Data, SGA research

Source: Federal Reserve Economic Data, SGA research

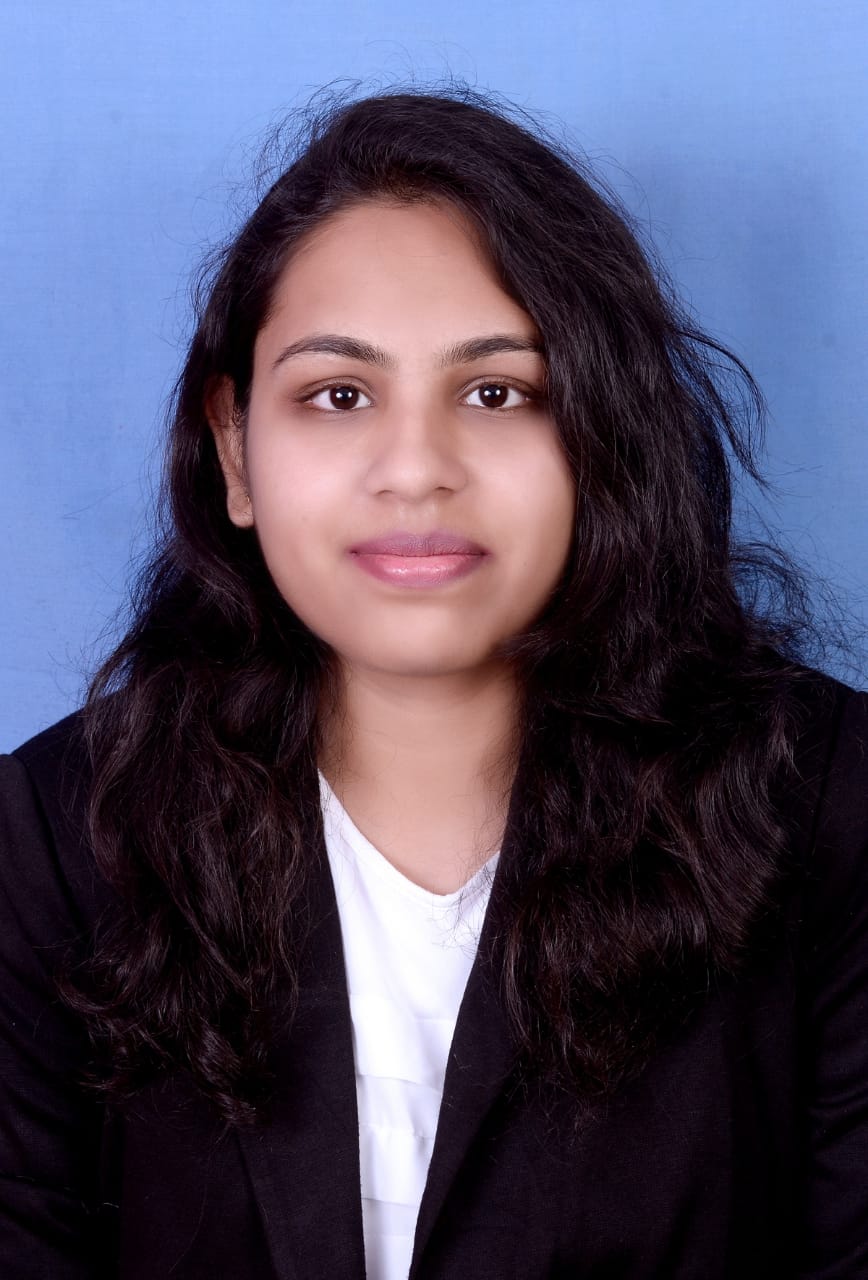

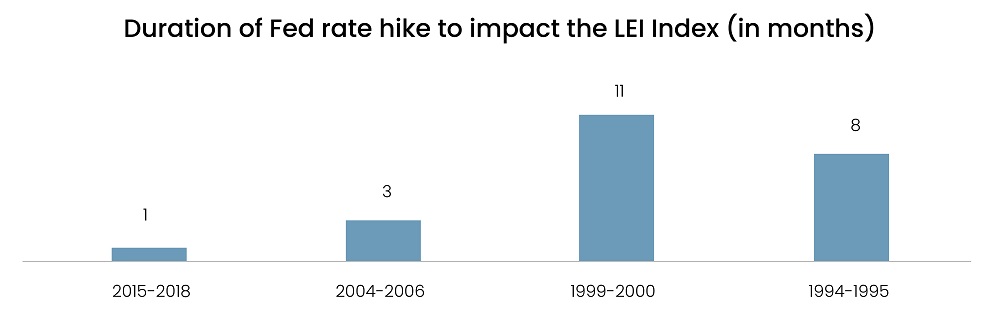

Rate Hikes Scenarios

The impact of Fed rate hikes during 1994–95 was observed after nine months on the PMI and eight months on the LEI index, whilst the impact of Fed rate hikes during 1999–2000 (The Dot-Com boom) was evident after six months on the PMI and 11 on the LEI index. Exceptions were also noted in rate hike cycles such as 2015–18 and 2005–06, where the impact of rate hikes was witnessed in a remarkably shorter period.

Source: Federal Reserve Economic Data, SGA research

Source: Federal Reserve Economic Data, SGA research

Effect of Monetary Policy on the Economy

The long response time to reflect on the LEI and PMI indexes suggests that it takes time for the economy to fully absorb and adjust to the effects of monetary policy. On the other hand, we also observed that monetary policy shocks shift to the economy over very short lags, with economic activity and manufacturing orders displaying notably different dynamics. This was due to the prevailing macroeconomic factors. Additionally, the transparency of the Fed and the dynamics of financial markets have accelerated the transmission of these effects. Market participants anticipate policy changes well in advance, leading to economic effects before the actual adjustments in the policy rate are implemented.

Read more: Savings Squeeze: A Looming Threat on the Economic Landscape

What Lies Ahead for the US in the Current Scenario?

In the current scenario, the U.S. economy is still showing resilience despite the Fed’s rapid 525bps rate hikes since March 2022. However, the full consequences of these tight monetary policy measures are yet to unfold. Historical patterns suggest a lag of six to nine months for the economy to fully absorb such policy changes. It is important to note that the changes in interest rates affect the economy through various channels, including borrowing costs, consumer spending, business investment, and asset prices. The speed at which these transmission mechanisms operate can vary.

Some areas, such as bond yields, corporate earnings, and liquidity, are already feeling the impact of tight monetary policy. In contrast, other areas, such as the labor market, are still absorbing the effects. It seems that monetary tightening is more of an art than a science. Policymakers can make small adjustments to the economy to either accelerate or decelerate its pace, much like adjusting a thermostat to maintain a comfortable room temperature. That said, it is likely to take time for the full impact of interest-rate changes to pass through all three stages of the monetary transmission mechanism (first: asset prices, second: demand, last: inflation).

Some economists are comparing the current U.S. economic scenario with the 1970s, where central bankers (allegedly) reduced interest rates before the inflation battle was won. However, policymakers are now more cautious about premature easing, perhaps because of sticky inflation. Typically, there are two types of easing cycles: during recessions and as pre-emptive measures against adverse outcomes. Empirical research indicates that when central banks cut rates in response to economic weakness, the recovery tends to be prolonged. Conversely, when easing policies are implemented as ‘insurance’ against potential downturns, the economic rebound tends to occur more swiftly. This pattern was observed in 1995 and 1998 when it took about 7 months (more than two quarters) to stimulate economic growth. Unless there is a significant deterioration in the global economic outlook, it seems that the latter scenario is the more relevant framework for 2024.

Read more: Shifting Strategies: Venture Capital’s Shift to Secondary Markets

In Conclusion

Based on the above research, even if the Fed initiates rate cuts starting in June, it will take six to nine months for the economy to recover from the effect of rapid hikes. Moreover, geopolitical developments such as ongoing Middle East tensions and upcoming elections are also likely to impact the pace of the economic rebound. Thus, the US economy should start recovering by the beginning of 2025.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

A market leader in Investment Research, SG Analytics assists in strengthening investment decisions by leveraging custom research support. Contact us today if you are in search of an investment research firm that offers tailored research support across a broad range of asset classes.

About SG Analytics

SG Analytics (SGA) is a global data solutions firm that harnesses data with purpose across the data value chain - from origination, aggregation, management, modernization, and analytics to insights generation to create powerful business outcomes for its customers. Through its research and data analytics consulting services, SGA marries content with context to provide bespoke solutions to its customers, enabling them to improve efficiency, scale, and grow. The company has a presence in New York, London, Zurich, Seattle, Austin, San Francisco, Toronto, Pune, Bangalore, Hyderabad and Wroclaw. The firm serves customers across the banking, financial services and insurance (BFSI), technology, media and entertainment (M&E), and healthcare sectors, amongst others, including Fortune 500 companies.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.