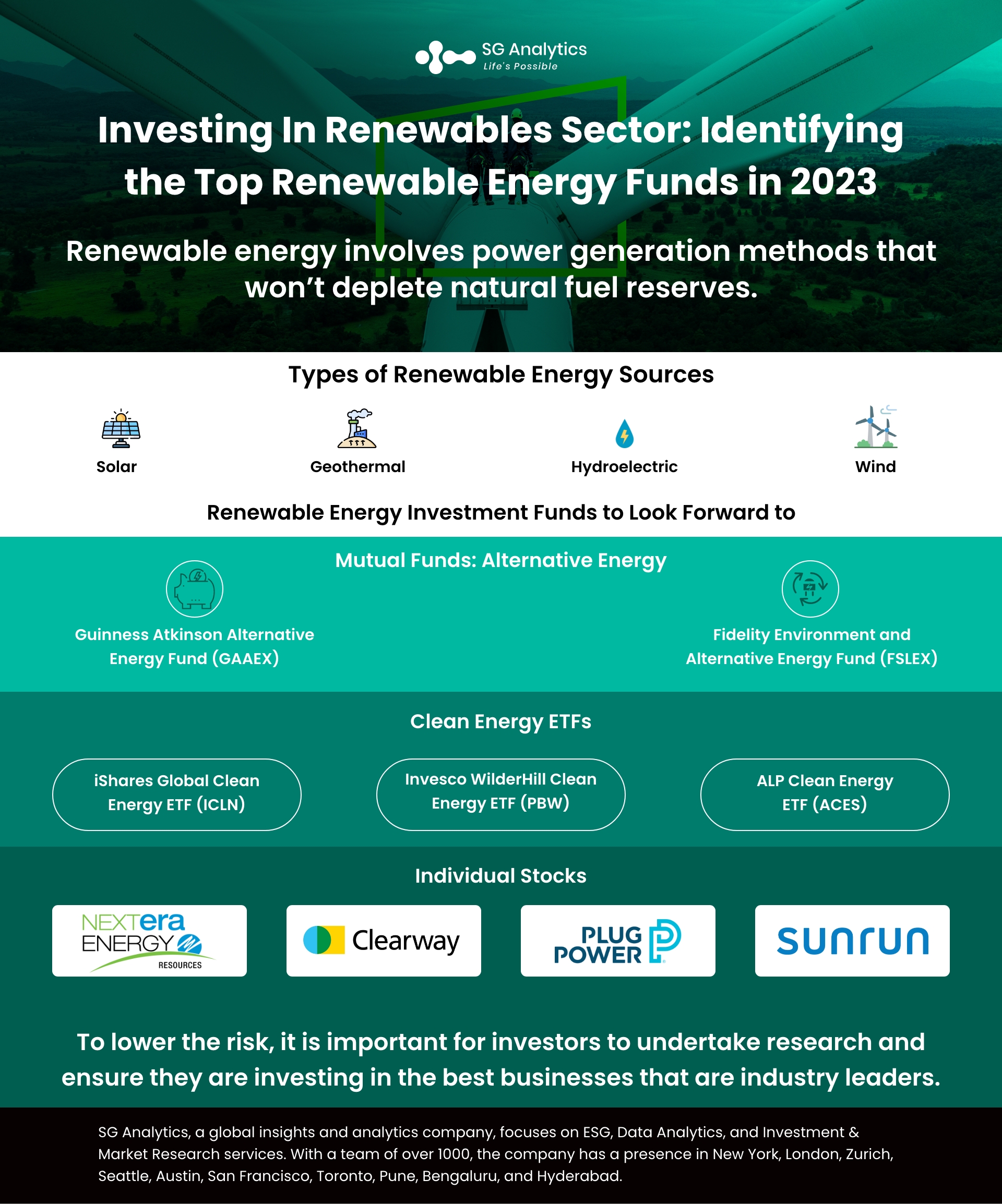

Renewable energy involves power generation methods that do not deplete natural fuel reserves. Many organizations in the energy sector are developing ways to generate electricity that have less impact on the environment and lead to zero carbon emissions.

Burning fuels leads to releasing pollutants into the air, thus impacting the quality of life for the earth's inhabitants. In the last few years, industries have seen a significant rise in anti-pollution technology, such as fuel injection in cars, to facilitate the efficient burning of fuel and smokestacks to reduce carbon emissions. Companies are also employing measures for carbon reduction, as coal - as fuel - is vital for power generation. However, irrespective of this headway, reaching a state of zero carbon emissions is challenging as well as expensive. Due to this, there has been more focus on renewable energy sources.

Types of Renewable Energy Sources

Multiple renewable energy sources that have been developed are currently being employed for the generation of power at all consumption levels. The types most commonly in use include:

-

Solar

-

Geothermal

-

Hydroelectric

-

Wind

Read more: Spotlight on EV Battery Technology as the US looks to Challenge China’s Dominance

Investing in Renewable Energy

Countries across the globe are changing their stance and switching to adopting greener power sources. Due to this reason, the prospect for renewable energy companies has never looked brighter. Taking into consideration the recent developments, the industry is set to grow at an even more rapid pace than current forecasts.

With the global economy striving to switch energy sources due to rising climate change concerns, organizations are moving away from carbon-based fossil fuels and opting for alternative energy sources like renewable energy. The decarbonization of the global economy is set to be more than $150 trillion investment over the next few decades. And renewable energy will play a major role in this transition.

How to Invest in Renewable Energy Sources?

Renewable energy sources supply almost 20% of the electricity generated by the power sector. However, climate change crises are forcing companies and other institutions to focus on doing their part to decarbonize. Many companies are signing power purchase agreements or PPAs and other electricity generators to purchase power produced from renewable sources specifically. Meanwhile, others enterprises are investing in renewable energy development projects.

While some investors are opting for renewable investments to be regarded as socially responsible citizens, renewable energy is increasingly economical due to the falling costs of solar panels and batteries for energy storage. This is making the sector more attractive for new investment opportunities.

Investing in renewable energy is an easy task. It requires picking an individual stock, mutual fund, or even an exchange-traded fund (ETF) that focuses on green energy. If an investor opts for a mutual fund or ETF, they may also invest in traditional energy companies. As the big oil companies rely on fossil fuels, many investors are transitioning to invest in renewable energy. However, it is important to understand the underlying company fund to invest in. Let's explore the top organization funds to invest in the renewable energy industry.

Read more: Sustainability Outlook: Top Emerging Trends in 2023 and Beyond

Renewable Energy Investment Funds to Look Forward to

-

Mutual Funds: Alternative Energy

-

Guinness Atkinson Alternative Energy Fund (GAAEX)

The GAAEX, or the Guinness Atkinson Alternative Energy fund, focuses on alternative energy companies that have a minimum market cap of $500 million. Starting in 2006, the fund has returned 8.17% in the last decade. From the period of January to September 2022, the GAAEX fund has been down by 21.76%. The fund invests 80% of its net assets in green energy enterprises.

-

Fidelity Environment and Alternative Energy Fund (FSLEX)

The Fidelity Environment and Alternative Energy fund, or the FSLEX, invests a minimum of 80% of its net assets in organizations that are engaged in renewable energy, water infrastructure, energy efficiency, recycling technologies, and other significant environmental support services. The fund returned 10.65% in the last ten years. However, it has been down 22.39% this year.

-

Clean Energy ETFs

-

Invesco WilderHill Clean Energy ETF (PBW)

The Invesco WilderHill Clean Energy ETF, or the PBW, is like the iShares Global Clean Energy ETF but contains securities from companies in the U.S. The fund incorporates stocks from almost 82 companies and is more volatile due to its focus on small-cap stocks. This volatility can be reflected in its year-to-date return, which was negative 35.69%.

-

iShares Global Clean Energy ETF (ICLN)

The ICLN or the iShares Global Clean Energy ETF tracks the S&P Global Clean Energy Index. It is a highly diverse fund and contains stocks that represent every corner of the renewable energy industry. This involves solar, geothermal, hydroelectric, wind, and more. The ICLN invests in organizations across the globe, and the fund has been down 8.29% to date.

-

ALP Clean Energy ETF (ACES)

ACES contains clean energy securities from corporations in the U.S. and Canada. The ACES fund concentrates on stocks that are issued by companies interested in developing renewable energy. In 2022, to date, the ETF has been down 11.13%. However, since its inception, the fund has been up 21.96%.

Read more: Next In: Enterprise Sustainability Investments in Technology

-

Individual Stocks

-

Plug Power (PLUG)

A hydrogen and fuel cell system company, Plug Power is at the forefront of hydrogen energy. While the hydrogen energy market is still in the very initial stages, these stocks are said to be very volatile. Year to date, the PLUG shares are down 38%. However, over the past five years, they have been up 669%.

-

Sunrun (RUN)

A solar energy company, Sunrun caters to the residential market globally. The company designs, develops, as well as installs solar panels on residential rooftops. As long as the energy sector witnesses a high price range for solar energy, Sunrun will be able to continue to add to its business, as consumers are now transitioning to adopt sustainable means to save on their monthly energy costs. Year to date, the shares of Sunrun have been down by roughly 11%. In the past five years, they were up 418%.

-

NextEra Energy (NEE)

NextEra is one of the leaders in solar and wind energy. The company is now incorporating measures to eliminate carbon emissions from its operations by the year 2045. In the last five years, the NEE stock was up 113%; however, in 2022, they have been down 9%.

-

Clearway Energy (CWEN)

Clearway Energy generates wind and solar energy, and they sell their energy to other enterprises. The company employs a strong financial foundation which further strengthens the sale of its thermal business. CWEN stock has been down 1%.

Key Takeaways

-

Considered a niche segment, the renewable energy sector is rapidly becoming a vital source of power around the world.

-

Renewable energy is friendly to the environment when compared with fossil fuels.

-

Green energy is focused majorly on wind and solar. However, companies are exploring hydrogen as a potential fuel source.

-

Green energy is also a popular investment as more people are realizing its impact on climate. However, with many renewable energy investments to choose from, this sector is becoming overwhelming to investors.

-

The largest renewable energy companies today are headquartered in Spain and Denmark. And other top players are stationed in China, the U.S., and Canada.

Read more: How is Multi-stakeholder Assessment Helping to Create Long-Term Sustainable Value?

To Sum Up

Even when investments are or are not in favor of investors, clean energy investments are here to stay for the long run. Due to the rising need to solve the global climate crisis, many renewable energy companies today are leading the course for a brighter future. However, this means only some companies out there today will be here tomorrow. To lower their risk, it is vital for investors to undertake thorough research and ensure they are investing in the best businesses that are industry leaders.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.