Disney recently acquired a $1.5 billion equity stake in Epic Games, marking its biggest investment yet in the gaming industry. With this investment, Disney is aiming to integrate its iconic characters and intellectual assets into the games and entertainment universe. This prominent example highlights the gaming industry's expanding potential as well as the market’s eagerness to participate in its growth.

In sync with the broader VC market, the gaming industry faced challenges over the past year, experiencing sluggish fundraising, mass layoffs, and closure of studios. However, there is a positive outlook for 2024, driven by a transforming ecosystem that has cultivated a favorable environment for growth. The use of AI and web3 in game development, as well as the integration of virtual and augmented reality (V/AR) into the games themselves, presents unbounded opportunities. As a consequence of these developments, investor interest in the gaming industry has been revived.

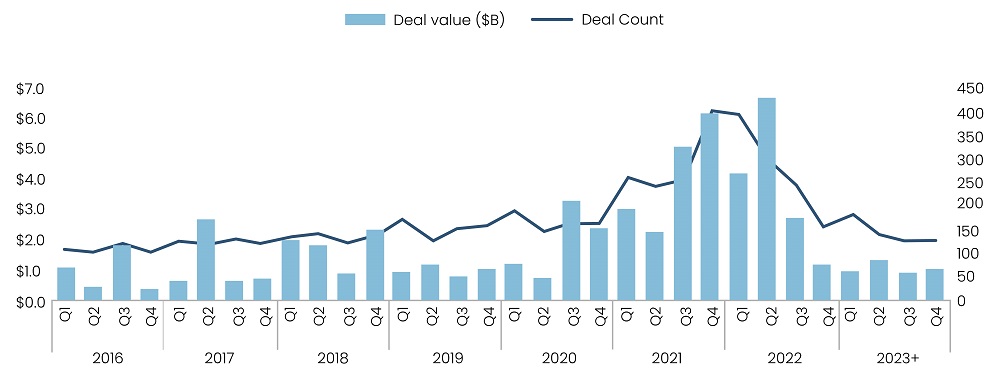

The past year experienced a readjustment from the 2021-22 period of mass tourist investors influx. Newzoo projects that the gaming market is poised to return to an organic growth trajectory, anticipating a 2.8% increase this year, reaching a total of $189.3 billion. Already, the gaming VC landscape exhibited improvement in 4Q23, with a total of 126 deals amounting to $1 billion, marking quarterly increases of 0.8% and 10.4%, respectively, per Pitchbook.

Figure 1: Gaming VC Deal Activity by Quarter

Source: Pitchbook

Read more: Venture Capital Outlook 2024

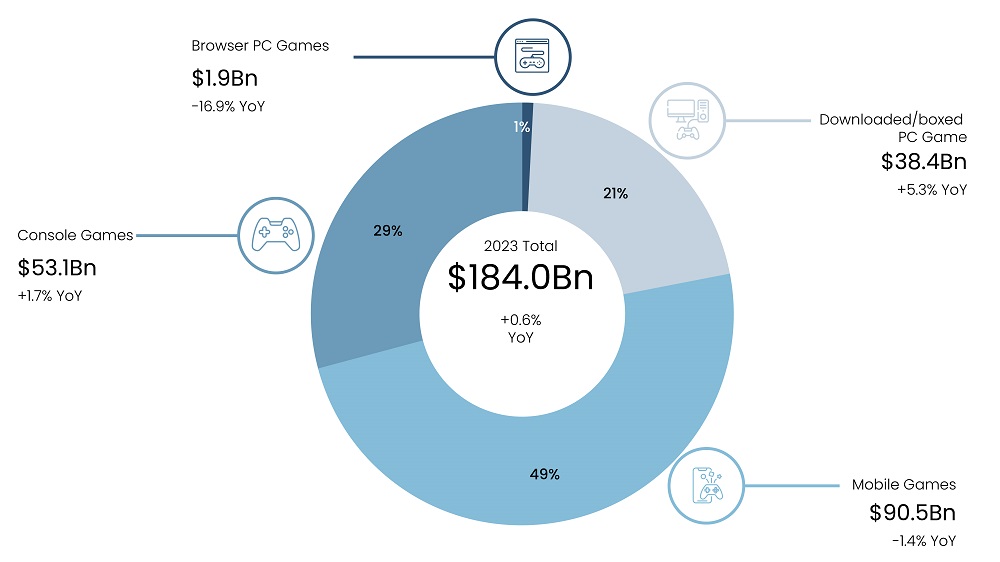

For the moment, mobile publishers constitute half of the industry and traditionally attract the most venture funding. However, they are currently grappling with challenges related to monetization and user acquisition, stemming from evolving dynamics within the app stores provided by Apple and Google. The gaming industry, taking note of the implications, is pivoting towards cross-platform games, especially those designed for consoles and PCs.

Cross-platform games are considered a lucrative space in the current environment due to their wider market reach and increased potential for revenue generation. According to VB Live, developing cross-platform compatibility can increase revenue by 20-40%. Live-service games in this category have become noteworthy, with third-party offerings leading the charts in terms of monthly active users and revenue across multiple platforms, according to a Newzoo report. The report highlights that the mobile games segment was anticipated to face a revenue decline of 1.4% in 2023, whereas sales for console and PC games were projected to grow by 1.7% and 5.3%, respectively. This strategic reorientation towards segments that offer more robust growth prospects makes the industry more appealing to investors.

Figure 2: Global Games Market Segmentation

Source: Newzoo

While the AI fervor in 2022 prompted many industries to showcase their AI capabilities, its potential impact on the video game sector wasn't immediately noticeable. However, companies are now beginning to introduce AI into the industry, facilitating cost savings through streamlined game development processes.

Read more: The Dragon's Dilemma: China's Path in a Shifting Global Landscape

AAA game development, for example, is known for its challenges, which are marked by escalating budgets, expansive scopes, and development timelines typically stretching beyond five years. Although revenues have generally surpassed escalating costs driven by innovative monetization strategies, the advent of AI is poised to enhance these established production models. A recent survey by Andreessen Horowitz involving 243 game studios regarding adopting AI tools disclosed that 87% are currently employing AI, and 99% have intentions to integrate it into their upcoming projects. Noteworthy tools include ChatGPT and Midjourney, alongside Leonardo.ai and Scenario, two generative AI systems tailored specifically for gaming applications. Additionally, 64% of the surveyed studios expressed plans to train or refine language models using their own data in future endeavors.

Web3 gaming, a decentralized process of developing immersive and interactive games, is also anticipated to experience substantial growth, with a projected CAGR of 18.7%, increasing from $23 billion in 2023 to $133 billion in 2033, as reported by Future Market Insights. Game7 notes a 40% growth in blockchains, specifically targeting the gaming sector in 2023, with the announcement of over 81 new blockchain networks. Distribution has historically posed challenges for the industry, relying on direct channels or web3 native platforms. Notably, platforms like the Epic Games store have demonstrated increasing support, progressing from listing only two games in June 2022 to featuring 69 games by October 2023. This growth is attributed to new monetization opportunities, decentralized governance, enhanced interoperability, and improved user experiences offered by Web3 gaming.

V/AR also represents a burgeoning field set to propel the gaming industry forward. According to IMarc, the global AR gaming market is expected to witness substantial growth, projecting an increase from $11 billion in 2023 to $102 billion in 2032, with a noteworthy CAGR of 27.2%. Similarly, the global VR in the gaming market is poised to experience a CAGR of 22.7% from 2023 to 2030, per Grand View Research. The launch of much-anticipated standalone headsets like Apple’s Vision Pro and Meta’s Quest Pro is expected to mainstream the VR sector, contributing to an expanding VR ecosystem and robust commercial growth.

Read more: Shifting Strategies: Venture Capital’s Shift to Secondary Markets

In conclusion, despite challenges, the video game industry is undergoing a dynamic resurgence in 2024 driven by a transformative ecosystem, unbounded opportunities represented by AI, web3, V/AR, and renewed investor interest. The gaming VC landscape is showing improvement, with a shift towards organic growth. There is a strategic reorientation as developers pivot towards cross-platform games to optimize returns as market conditions evolve. The integration of AI, the increasing acceptance of web3 gaming, and the rise of V/AR are further shaping the industry's evolution.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our brand promise of "Life's Possible," we consistently deliver enduring value and ensure the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.