2023 was a mixed bag for the US VC sector that navigated between growth and survival. Notable events like the downfall of Silicon Valley Bank brought hurdles, yet the surge in generative AI provided a silver lining. Looking ahead, the VC outlook appears robust, energized by AI-driven innovation and a public market gearing up for a wave of IPOs.

Strategic Realignment and Fundraising Enhancement

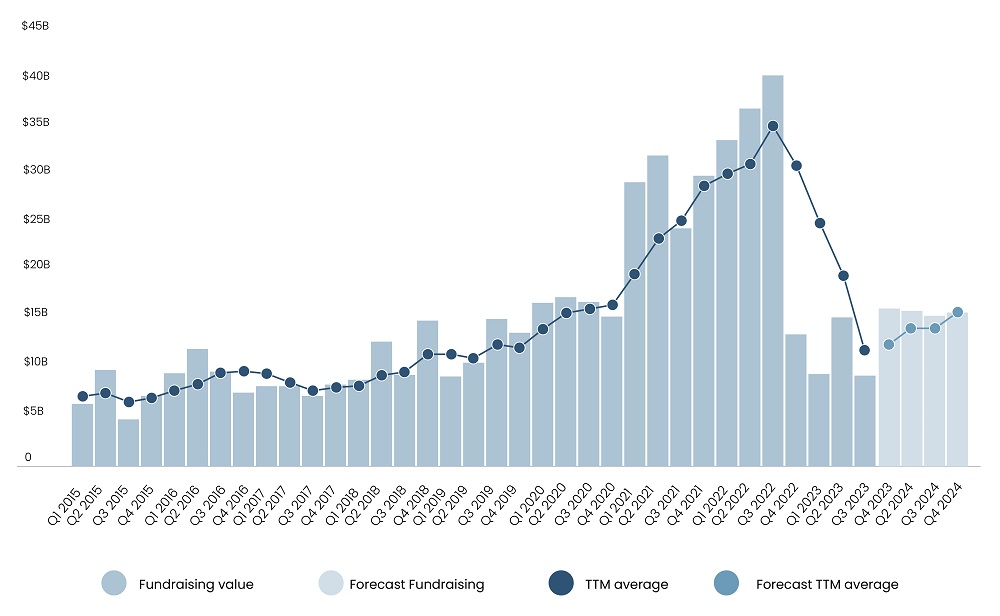

In 2023, VC firm fundraising experienced a steep 60% year-on-year decline from $173 billion to $67 billion, hitting a six-year low, per Pitchbook and the National Venture Capital Association. The predominant factor contributing to this downturn is the muted exit environment, resulting in an extended holding period for capital, which is recycled into new VC funds. According to Pitchbook, the rate of capital distribution back to investors is currently at its lowest since 2003. As startups cope with exit and valuation pressures, these conditions indicate a necessity for investors to readjust their expectations. The sluggish fundraising trend is anticipated to persist in the short term, exerting downward pressure on startups. Venture capital firms are likely to adapt their pace of capital deployment, becoming more selective under challenging market conditions and decreasing dry powder figures as capital commitment surpasses fundraising. Consequently, elevated capital demand-to-supply ratios are likely to persist, fostering an environment conducive to investor-friendly dealmaking in the foreseeable future. The new year is expected to bring a slight increase in total funding to be on par with 2020 figures, according to a Pitchbook model that estimates the impact of recent distributions on future fundraising efforts.

Read more: Key Takeaways from Consumer Electronics Show (CES) 2024

Figure 1: Quarterly US VC Fundraising with Trailing Four-Quarter Average and One-Year Forecast

Source: Pitchbook

Anticipated Improvement in Exit Activity

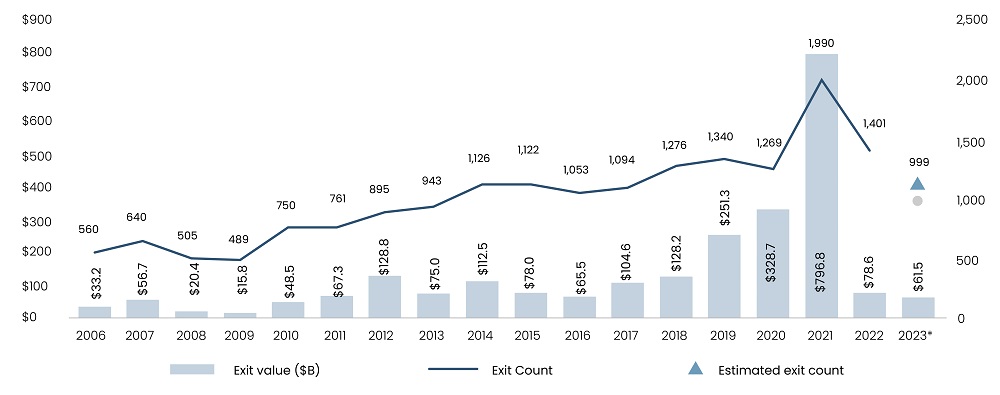

Exit activity in 2023 remained subdued, leading to an industry-wide liquidity crunch. Tech IPOs, contributing only 8.4% to public exits, marked a decrease from 15.4% in 2021. Despite notable IPOs like Klaviyo and Instacart, overall exit values were at a decade-low. While M&A played a larger role in exits in the past two years, heightened regulations and scrutiny continue to present challenges for this alternative exit avenue. M&A activity involving VC-backed companies experienced a 48% decrease, totaling just over 1,600 deals, down from the 3,100 deals finalized in 2021, per Crunchbase. The outlook for 2024, however, is more optimistic. In a survey conducted by TechCrunch with over 40 investors, the majority expressed optimism about an improvement in exit volumes in 2024. This positive outlook is driven by the high expectations surrounding anticipated IPOs. Reddit, the social discussion platform, is preparing for a long-overdue IPO in March. Fintech giant Stripe is anticipated to initiate its IPO soon. Meanwhile, Shein, the Chinese fast-fashion giant, has confidentially filed for a US IPO, aiming for a listing in 2024 with a valuation ranging between $60 billion and $90 billion.

Figure 2: US VC Exit Activity

Source: Pitchbook

Read more: Top Four Sectors to Watch Out for in 2024

Shrinking Fund Sizes

VC firms have been scaling down mega-funds raised, and this trend is expected to continue into 2024, with average fund sizes getting smaller. Over the past decade, propelled by a technology bull market, VCs consistently raised larger funds. This resulted in overvalued stakes as the market declined, prompting firms to adopt a more prudent approach. Y Combinator, for instance, discontinued Continuity, its growth investment arm that had invested over $3 billion into late-stage startups. Social Capital, a California-based VC, abandoned its plans to raise a $1 billion fund. Tiger Global Management, having invested a significant portion of its latest $12.7 billion fund when startup valuations peaked in the years 2021 and 2022, downsized its targeted fund size. In recent years, the prevalence of billion-dollar funds has waned, with only ten such funds closing in 2023, per Pitchbook. The average fund size witnessed a 14.7% decline from its peak in 2022 to $141.8 million as of November 2023. This decline is anticipated to continue into 2024 as managers readjust their target fund sizes to participate in a market with adjusted valuations and deal sizes.

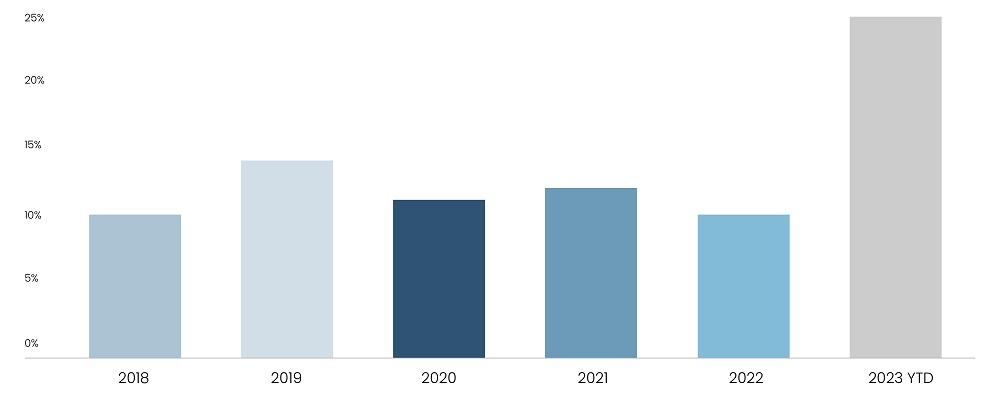

Continued Growth of AI

Despite an overall slowdown in funding, the AI industry maintained a rapid growth trajectory. The proportion of total investments directed towards AI-related startups doubled compared to levels from a year ago, with more than one in every four dollars invested now allocated to AI, according to Crunchbase. Within this sector, the Gen AI segment is experiencing significant growth. Investments in Gen AI startups surged from $5.1 billion in the year 2022 to $21.4 billion in 2023, according to Pitchbook. With an influx of emerging projects and increasing demand for the technology, the market is poised for further expansion, projected to reach $1.3 trillion over the next decade from a 2022 market size of $40 billion, per Bloomberg Intelligence.

Heading into 2024, a major driver will be the integration of these technologies into specific business operations, focusing on disruptive innovations capable of transforming various industries. The healthcare industry is anticipated to lead the way in adopting AI. A study published by the Journal of American College of Radiology showed that 85% of digital health’s VC funding was allocated to medical imaging and concluded that additional funding is expected to increase AI products commensurately. Alongside a growing demand from the healthcare industry, this segment is set for significant expansion. As per the report released by Morgan Stanley, the industry's average estimated budget allocation for these technologies is expected to increase from 5.7% in 2022 to 10.5% in 2024. Recognizing this opportunity, Google recently announced its investment in 15 AI-powered projects, including eight digital health initiatives aimed at enhancing provider experience and improving patient access to care.

Read more: 2024 Macroeconomic Outlook: Unpacking Economic Trends

Figure 3: Percentage of US Venture Funding Going To AI-Related Startups

Source: Crunchbase

Geopolitical Uncertainty

A prominent source of uncertainty in the upcoming year stems from escalating geopolitical risks in the macroeconomic environment. The intensification of trade tensions with China, the ongoing conflict between Ukraine and Russia, and the growing disputes in the Middle East, coupled with the approaching Presidential elections, will continue to exert significant influence on VCs. In response to increasing political pressures on US companies to restrict investments in China, Sequoia and GGV Capital have recently disassociated from their China divisions. In August 2023, President Biden issued an executive order limiting outbound investments to China, Hong Kong, and Macau, specifically targeting industries crucial to US national security, including advanced computing chips and microelectronics, quantum technology, and AI. As we move into 2024, startups and VCs must navigate a complex terrain of regulatory pressures and international relations.

The VC Outlook for 2024 reflects resilience despite the challenges of the past 18 months, marked by geopolitical tensions and a funding drought. Fundraising faced a 60% decline in 2023, hitting a six-year low, with a muted exit environment. However, the industry anticipates strategic realignments and improved exit volumes in 2024, driven by optimism surrounding anticipated IPOs. VC firms are scaling down mega-funds, and the AI industry, despite a funding slowdown, maintains growth; both trends are likely to continue in the near term. Geopolitical uncertainties pose challenges, and as we enter 2024, startups and VCs navigate a complex landscape of regulations and international relations.

Read more: App Store Monopoly Contested: Value Shifts Towards Application Layer

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose and merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & and domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.