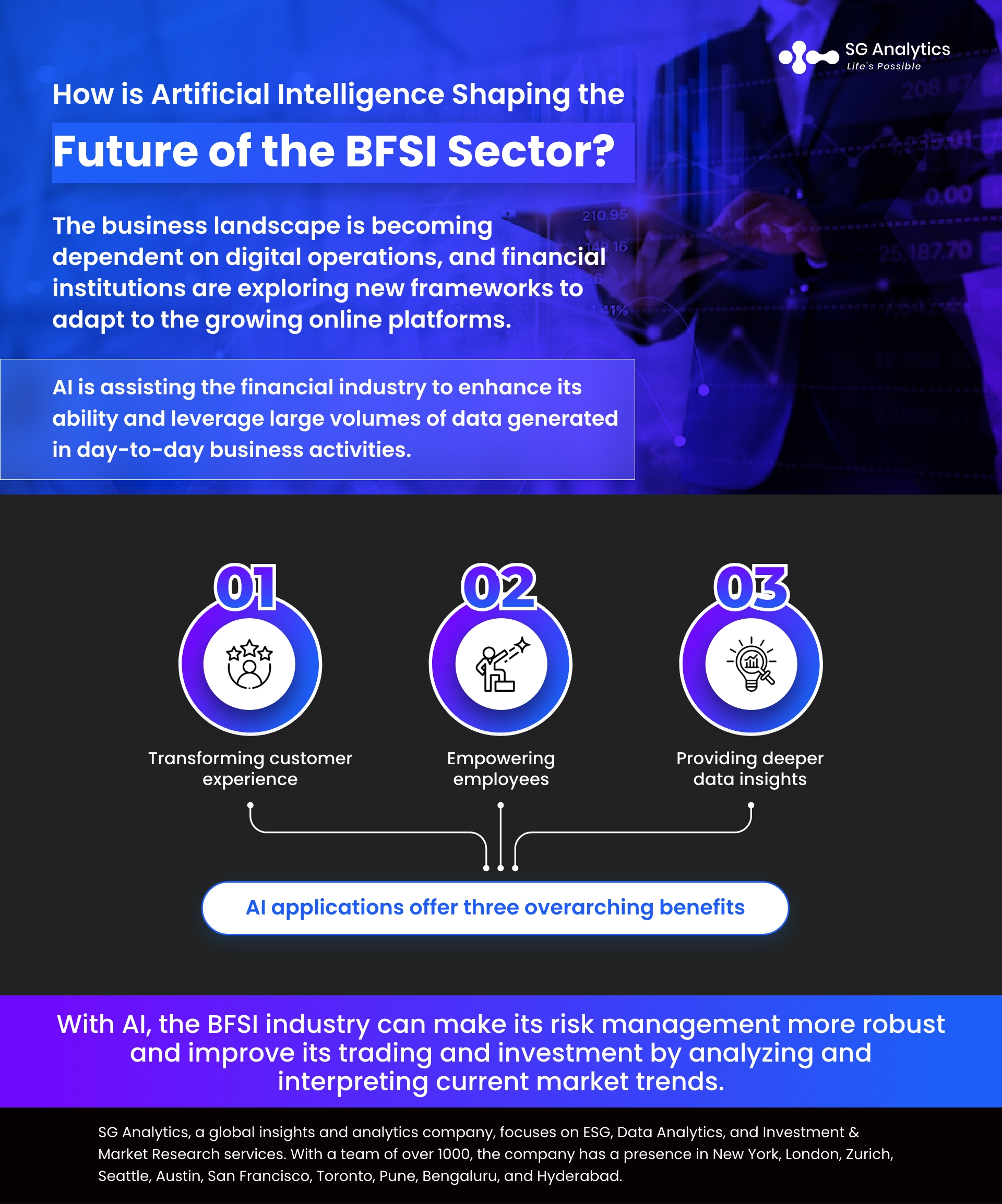

With the business landscape changing and becoming increasingly dependent on digital operations, financial institutions are exploring new frameworks to adapt to the growing online platforms. The rising tide of artificial intelligence (AI) is also changing the way businesses operate and invest. And with the growing pressure to remain innovative, financial institutions are moving to cloud-based platforms and AI-enabled solutions to offer their customers the best solutions. And at the very core, AI is assisting the financial industry to enhance its ability and leverage large volumes of data generated in day-to-day business activities. It is further assisting in identifying patterns, making predictions, creating rules, automating operations, and communicating with the customers more efficiently.

For financial service providers, AI capabilities are very suitable due to the data-intensive and technology-dependent nature of the sector. There has been significant growth in opportunities across customers, risk, and operations, and AI sits at the top of the agenda for financial services.

- Customer: With customers becoming more and more informed, financial institutions are incorporating transparent and consistent solutions and making these services accessible on a 24/7 basis. AI is being leveraged to acquire a holistic view of the customer and offer timely support.

- Risk: 33% of banks today have allocated or are set to allocate more than 5% of their annual budgets to compliance. This is emerging as a major opportunity for financial institutions to leverage AI technologies in legal and compliance divisions as well.

- Operations: AI is enabling financial institutions to automate and standardize their process workflow and establish financial sustainability by reducing operating costs. They are also automating repetitive tasks, enabling employees to focus on high-value activities.

Read more: How is Data Analytics Transforming FinTech?

AI is being used successfully across different areas of the financial services industry, but there are certain areas where AI will not be as impactful or be a risky affair. It is, therefore, vital for banking and financial services organizations to be smart about choosing appropriate use cases and technologies to yield value.

The BFSI industry is seeking ways to understand the different sentiments of their customers, including vulnerability and confusion, to ensure that the customers can receive the necessary support. By integrating an artificial intelligence framework, the industry is automating compliance on the bank’s secured lending calls to achieve high-impact outcomes. This included:

-

Full review coverage of customer interactions that is not operationally feasible in a traditional review approach

-

Directing review teams to high-risk call segments and interactions.

-

Gathering insight into the quality of customer interactions

-

Providing better customer experience by offering insight to multiple teams across the organization

The role of AI in financial services is enabling them to transform their existing customer contact center dramatically. By improving customer satisfaction and loyalty, they can increase efficiency and cultivate effortless and personalized experiences. AI holds the potential to expand into new markets by creating differentiated offerings and leveraging capabilities on cloud platforms.

AI applications offer three overarching benefits –

-

transforming customer experience,

-

empowering employees

-

providing deeper data insights

Read more: Innovation in Defense Tech: Private Funding Opportunities on the Rise

The key to integrating AI and advancing business operations is to build a data-driven ecosystem backed by predictive and analytical capabilities for well-informed decision-making.

By analyzing the quantitative fairness of different standards and training data, financial institutions can ensure that no key fairness risks are being left unchecked in the implementation process. With AI, institutions can make their risk management more robust and improve their trading and investment by analyzing collected data faster and interpreting current market trends.

Key Highlights

-

With diverse opportunities to apply AI in the banking sector, it is critical to prioritize the potential applications that generate more business value. It is also important to consider the risks and avert the unforeseen events that can likely disrupt customer experience.

-

Implementation of AI technology in the BFSI sector requires a full roll-out cycle at every stage. The institutions need to establish clear communication channels to integrate the new technology. It is important to break the high-level plan into smaller phases to deliver early benefits.

-

Financial institutions should have a clear vision to use the new technology and identify frameworks that will work for them in the first place. By having the customer and service delivery at the core of every operation, they can create a foundation for the implementation of new technology and build use cases for implementation.

Read more: Investment Trends 2023: Top Tech Stocks to Keep an Eye On

Overcoming Obstacles

Financial services organizations are continuing to reshape customer engagement modalities and deliver solutions that are consistent, contextual, and personalized to compete in the currently evolving environment.

Businesses are implementing cloud solutions that provide a powerful and flexible platform to unlock business value and deepen customer connections. This helps in delivering personalized customer experiences while empowering the employees by streamlining the customer onboarding process and providing easy access to self-service tools.

Firms are further integrating AI to perform efficient operations by automating and processing data. They are also reshaping how they engage with customers to deliver products and services successfully whilst improving employee experiences. Cybersecurity is also emerging as a priority due to the growing number of cybercrimes.

With the right tools and insights, financial institutions can increase their productivity and efficiency whilst delivering better and more meaningful customer engagements. Organizations must use AI technology responsibly and be prepared for unintended consequences. This is essential to ensure compliance and maintain trust. With a whole variety of financial service providers to choose from, financial firms are investing in AI-powered analytics and machine learning frameworks that allow them to avoid and mitigate potential negative experiences proactively. This further helps in creating a positive impact on customer retention, thus offering new ways to attract new customers.

The use of AI-powered insights is also creating more human-focused and personal service experiences, allowing employees to devote time to other operations. AI is also being used to provide personalized, real-time offers. What’s more - AI technology can also help control and prevent attempts of fraud, money laundering, and cyberattacks through its predictive qualities.

Read more: US-China Tech Rivalry: Implications for Venture Capital and the Chips Ecosystem

Future of AI in BFSI

Today, financial institutions are realizing significant gains from AI in deriving more insights from the collected data than ever before. They are integrating AI, ML, and analytics into their operational framework as well as customer life cycle to identify trends, protect assets, and offer personalized customer experiences. With AI, institutions are able to recognize, summarize, translate, predict, and generate solutions based on insights gained from massive datasets.

With AI optimizing market and operational risk management, the banking and finance industry is able to deliver risk insights, comply with regulatory conditions, and manage sensitive data against threats. Analytics is further powering modeling, insight, and regulatory reporting. Other AI-powered tools are also assisting in securing user identities and controlling access, protecting sensitive data and governing communications channels, as well as offering security against external cybersecurity threats and risks.

FinTechs have exhibited the power of data by integrating insights and improved analytics from different sources. Commercial banks are also closing this gap by using the power of AI to innovate. They are partnering with institutions to enhance their data-sharing capabilities, modernize and migrate their application portfolio, and create a secure digital workplace for their employees.

Banks and other financial institutions must seize this opportunity to navigate their way through the mountains of data that are underutilized, thereby generating incredible insights and value to be applied.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A market leader in the BFSI space, SG Analytics assists businesses with insightful, relevant research along with sophisticated technology solutions. Contact us today if you are in search of a BFSI firm that helps in driving value-accretive decisions and executing efficient processes to enhance the efficacy of your investments.